Unlike buying residential real estate, which requires more hands-on maintenance and upkeep, REITs are hands-off for investors. Is There a Difference Between REIT Dividends and Stock Dividends REITs and stocks can both pay dividends, usually on a monthly, quarterly, or yearly basis.Equity REITs

Properties can generate rental income, which, after collecting fees for property management, provides income to its investors. These REITs generate income from renting real estate to tenants. After paying expenses for operation, equity REITs pay out dividends to their shareholders on a yearly basis.Real Estate Investment Trusts (REITs) have become an interesting option for income investors due to their income payouts and capital appreciation potential. Distributions from REITs can provide income flow, but the income is considered taxable in the eyes of the IRS.

Do REITs generate passive income : With a REIT, you earn a share of the income the properties produce without having to buy, manage or finance them—making it a truly passive real estate investing option. REITs can be a good option for people who want to invest in real estate outside of their retirement accounts, but don't want to be a landlord.

What is the 90% REIT rule

To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

Is REIT a monthly dividend : Real estate investment trusts (REITs) are an investment that offers steady income. There are a handful of REITs that pay dividends on a monthly basis. Some of the most well-known monthly dividend payers include Realty Income (O), AGNC Investment Corp. (AGNC), and STAG Industrial (STAG).

It's possible to find REITs that allow you to invest with as little as $1,000 and some may have a minimum investment that's even lower. Keep in mind, however, that private or non-traded REITs may require much larger minimum investments of $10,000 or even $50,000 to buy in. REITs can be paid out in cash or a combination of cash and stock but must operate within specific requirements for REIT payouts. This includes the provision that each stockholder elects whether they receive their dividend distribution in all cash or a combination of cash and stock.

What is the 90% rule for REITs

How to Qualify as a REIT To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.Publicly traded REITs have the risk of losing value as interest rates rise, which typically sends investment capital into bonds.Here's an explanation for how we make money . More than a year of interest rate hikes by the Federal Reserve pushed down returns on real estate investment trusts, or REITs. While higher rates negatively impacted nearly every sector of the economy in 2022 and most of 2023, real estate was hit especially hard. To the inexperienced, this sounds like guaranteed dividends. There's only one catch: the payouts are not generated from the company's earnings. This largely explains why so many REITs have low payout ratios. In equity research, the payout ratio is the percentage of net income that a company pays out as dividends.

What are the disadvantages of REITs : Cons of REITs

Dividend Taxes. REIT dividends can be a great source of passive income, but the money you receive is subject to your ordinary income tax rate, which will depend on your tax bracket.

Interest Rate Risk.

Market Volatility.

You Have Little Control.

Some Charge High Fees.

Which dividends pay monthly : 7 Best Monthly Dividend Stocks to Buy Now

Monthly Dividend Stock

Market capitalization

Trailing-12-month dividend yield

Realty Income Corp. (O)

$48 billion

5.6%

Cross Timbers Royalty Trust (CRT)

$79 million

11.1%

Permian Basin Royalty Trust (PBT)

$555 million

5.8%

PennantPark Floating Rate Capital Ltd. (PFLT)

$701 million

10.8%

Does the S&P 500 pay dividends every month

Does the S&P 500 Pay Dividends The S&P 500 is an index, so it does not pay dividends; however, there are mutual funds and exchange-traded funds (ETFs) that track the index, which you can invest in. If the companies in these funds pay dividends, you'll receive yours based on how many shares of the funds you hold. The biggest risk to REITs is when interest rates rise, which reduces demand for REITs. 6 In a rising-rate environment, investors typically opt for safer income plays, such as U.S. Treasuries. Treasuries are government-guaranteed, and most pay a fixed rate of interest.However, there are a number of assets that pay income on a monthly basis. Options include savings accounts, certificates of deposit, annuities, bonds, dividend stocks, rental real estate and more.

How much return can you expect on a REIT : The FTSE Nareit All REITs index, which tracks the performance of all publicly traded REITs in the U.S., had an average annual total return (dividends included) of 3.58% during the five-year period that ended in August 2023. For the 10-year period between 2013 and 2022, the index averaged 7.48% per year.

Antwort Do REITs pay monthly? Weitere Antworten – How often does a REIT pay out

Unlike buying residential real estate, which requires more hands-on maintenance and upkeep, REITs are hands-off for investors. Is There a Difference Between REIT Dividends and Stock Dividends REITs and stocks can both pay dividends, usually on a monthly, quarterly, or yearly basis.Equity REITs

Properties can generate rental income, which, after collecting fees for property management, provides income to its investors. These REITs generate income from renting real estate to tenants. After paying expenses for operation, equity REITs pay out dividends to their shareholders on a yearly basis.Real Estate Investment Trusts (REITs) have become an interesting option for income investors due to their income payouts and capital appreciation potential. Distributions from REITs can provide income flow, but the income is considered taxable in the eyes of the IRS.

Do REITs generate passive income : With a REIT, you earn a share of the income the properties produce without having to buy, manage or finance them—making it a truly passive real estate investing option. REITs can be a good option for people who want to invest in real estate outside of their retirement accounts, but don't want to be a landlord.

What is the 90% REIT rule

To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

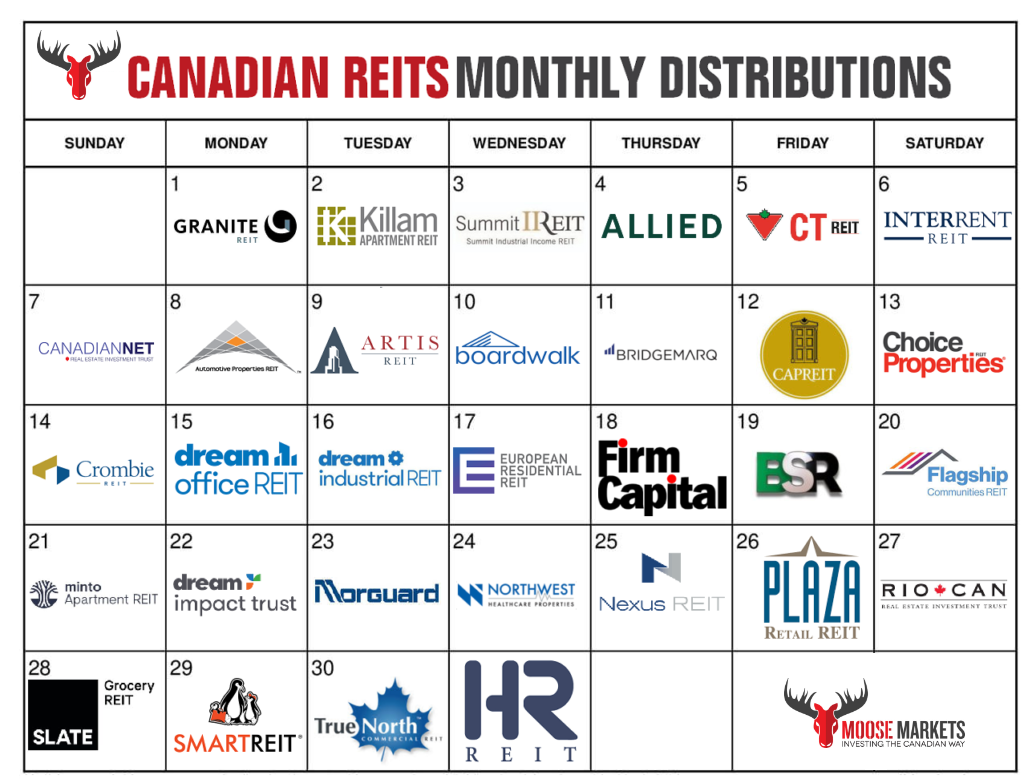

Is REIT a monthly dividend : Real estate investment trusts (REITs) are an investment that offers steady income. There are a handful of REITs that pay dividends on a monthly basis. Some of the most well-known monthly dividend payers include Realty Income (O), AGNC Investment Corp. (AGNC), and STAG Industrial (STAG).

It's possible to find REITs that allow you to invest with as little as $1,000 and some may have a minimum investment that's even lower. Keep in mind, however, that private or non-traded REITs may require much larger minimum investments of $10,000 or even $50,000 to buy in.

REITs can be paid out in cash or a combination of cash and stock but must operate within specific requirements for REIT payouts. This includes the provision that each stockholder elects whether they receive their dividend distribution in all cash or a combination of cash and stock.

What is the 90% rule for REITs

How to Qualify as a REIT To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.Publicly traded REITs have the risk of losing value as interest rates rise, which typically sends investment capital into bonds.Here's an explanation for how we make money . More than a year of interest rate hikes by the Federal Reserve pushed down returns on real estate investment trusts, or REITs. While higher rates negatively impacted nearly every sector of the economy in 2022 and most of 2023, real estate was hit especially hard.

To the inexperienced, this sounds like guaranteed dividends. There's only one catch: the payouts are not generated from the company's earnings. This largely explains why so many REITs have low payout ratios. In equity research, the payout ratio is the percentage of net income that a company pays out as dividends.

What are the disadvantages of REITs : Cons of REITs

Which dividends pay monthly : 7 Best Monthly Dividend Stocks to Buy Now

Does the S&P 500 pay dividends every month

Does the S&P 500 Pay Dividends The S&P 500 is an index, so it does not pay dividends; however, there are mutual funds and exchange-traded funds (ETFs) that track the index, which you can invest in. If the companies in these funds pay dividends, you'll receive yours based on how many shares of the funds you hold.

The biggest risk to REITs is when interest rates rise, which reduces demand for REITs. 6 In a rising-rate environment, investors typically opt for safer income plays, such as U.S. Treasuries. Treasuries are government-guaranteed, and most pay a fixed rate of interest.However, there are a number of assets that pay income on a monthly basis. Options include savings accounts, certificates of deposit, annuities, bonds, dividend stocks, rental real estate and more.

How much return can you expect on a REIT : The FTSE Nareit All REITs index, which tracks the performance of all publicly traded REITs in the U.S., had an average annual total return (dividends included) of 3.58% during the five-year period that ended in August 2023. For the 10-year period between 2013 and 2022, the index averaged 7.48% per year.