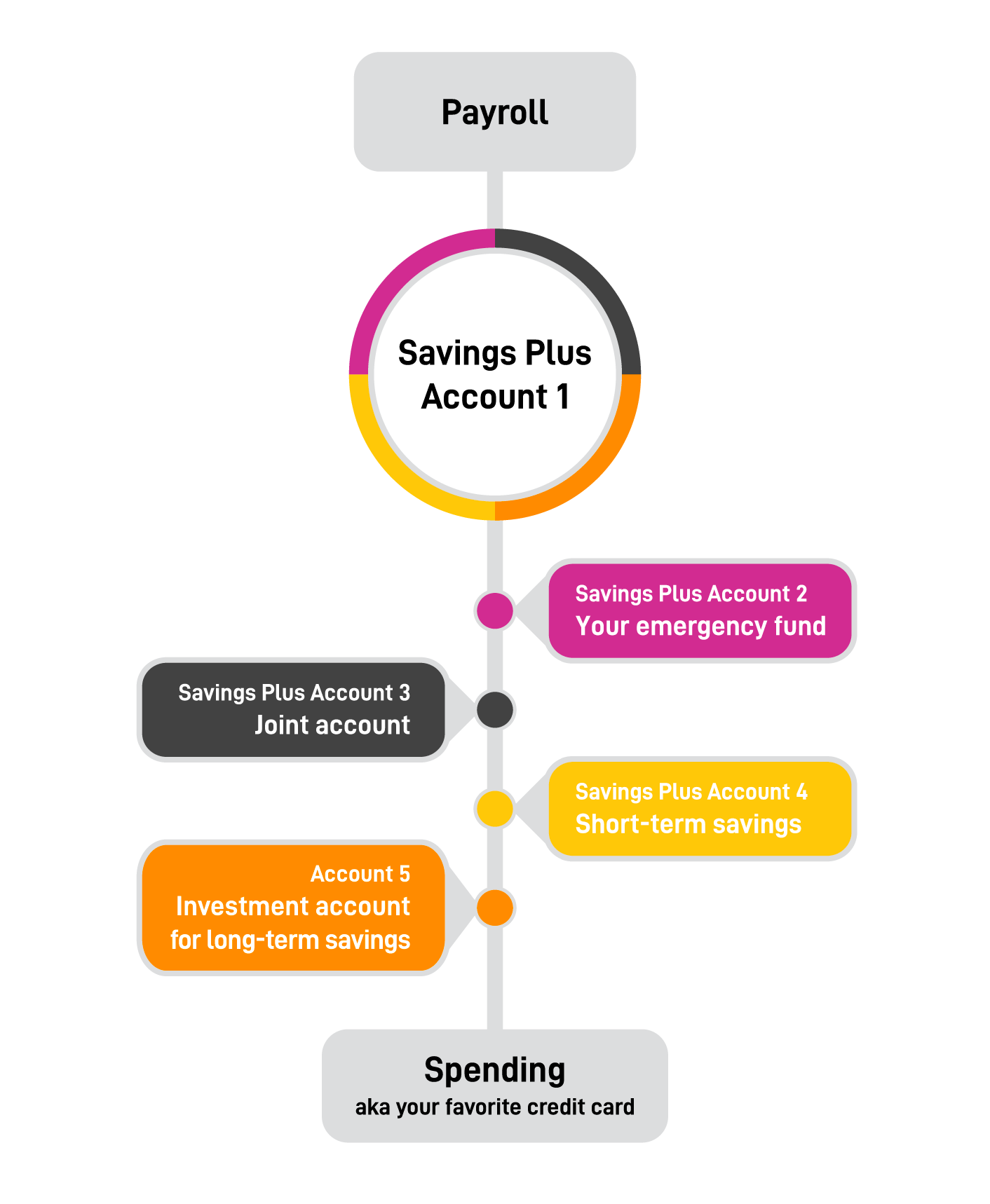

Should I have checking and savings accounts at different banks Keeping accounts at multiple banks can help your financial health. Having your checking account (and emergency savings) at a different bank than where you keep your long-term savings accounts can help you stay on track with your savings goals.According to financial experts, it isn't advisable to open more than three Savings Accounts, as it can be difficult to manage. Apart from having a minimum balance in each account, banks might also mark an account dormant if there is no activity for a period of time.According to a survey published in 2019, the average consumer in the U.S. has a total of 5.3 accounts across financial institutions. The share of households without access to at least one banking account has decreased consistently since 2011.

Is having multiple bank accounts bad for credit score : Will having two or more current accounts damage my credit score Not necessarily, no. However, having two or more current accounts won't necessarily damage your credit score, but it could have a negative impact if you start dipping into multiple overdrafts – making it look as if your finances are becoming stretched.

Is it smart to have two savings accounts

Bottom line. Having multiple savings accounts could help you keep your money covered by FDIC insurance, keep your emergency fund safe from spending, and help you better track your goals.

How many bank accounts are too many : While having multiple accounts can have its perks, it can also lead to confusion and complicate your financial life. If you find it hard to keep track of all the accounts and their balances, it's best to stick to one or two accounts.

There's no one correct answer, but it's usually best to start with at least two accounts—a checking account and a savings account. This gives you an everyday banking account for bills and other expenses and another for saving. Your bank account journey doesn't need to end there. The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

What percentage of people have multiple bank accounts

While about half of Americans have more than one bank account, 68 percent of those with $100,000 or more in savings have multiple accounts, according to market research firm YouGov. There are several ways that having multiple savings accounts can help make managing your personal finances easier.Average Savings By Age

Age Range

Account Balance

Ages 35-44

$27,910

Ages 45-54

$48,200

Ages 55-64

$57,670

Ages 65-74

$60,410

Drawbacks of Having Multiple Bank Accounts

Fees: It's possible to find several bank accounts that don't charge monthly fees, but if you decide to choose banks or credit unions that charge them, it can get expensive fast. Organization: It's important to stay organized if you have more than one bank account. If you're looking for a ballpark figure, Taylor Kovar, certified financial planner and CEO of Kovar Wealth Management says, “By age 30, a good rule of thumb is to aim to have saved the equivalent of your annual salary.

Should I keep all my money in one bank : Keeping all of your money in one bank can be convenient. But it's important to consider whether you're getting the best rates on savings and paying the lowest fees for checking accounts. It's possible that you could get a better deal by keeping some of your money at a different bank.

Is 7 bank accounts too many : You can have as many checking accounts as you want. Keeping track of multiple accounts is more complicated than a single checking account. However, opening and using multiple accounts can help you better manage your budget, cash flow, and other financial needs.

Is it smart to have two banks

Budgeting with multiple bank accounts could prove easier than with only one. Multiple accounts can help you separate spending money from savings and household money from individual earnings. Tracking savings goals. Having multiple bank accounts may help track individual savings goals more easily. As long as that bank is FDIC-insured and your deposit doesn't exceed $250,000, you should be safe to do so. It might be worth it to maintain an account at a separate bank, however, just in case a bank error or accidental account freeze results in a loss of access to your money for a time.Aim to have three to six months' worth of expenses set aside. To figure out how much you should have saved for emergencies, simply multiply the amount of money you spend each month on expenses by either three or six months to get your target goal amount.

Is $3 million enough to retire at 40 : Summary. $3 million should be more than enough to fund your retirement, even if you choose to retire early. A number of factors are at play when determining how long $3 million will last, including your investment strategy and retirement lifestyle.

Antwort Do most people have 2 bank accounts? Weitere Antworten – Is it good to have two bank accounts

Should I have checking and savings accounts at different banks Keeping accounts at multiple banks can help your financial health. Having your checking account (and emergency savings) at a different bank than where you keep your long-term savings accounts can help you stay on track with your savings goals.According to financial experts, it isn't advisable to open more than three Savings Accounts, as it can be difficult to manage. Apart from having a minimum balance in each account, banks might also mark an account dormant if there is no activity for a period of time.According to a survey published in 2019, the average consumer in the U.S. has a total of 5.3 accounts across financial institutions. The share of households without access to at least one banking account has decreased consistently since 2011.

Is having multiple bank accounts bad for credit score : Will having two or more current accounts damage my credit score Not necessarily, no. However, having two or more current accounts won't necessarily damage your credit score, but it could have a negative impact if you start dipping into multiple overdrafts – making it look as if your finances are becoming stretched.

Is it smart to have two savings accounts

Bottom line. Having multiple savings accounts could help you keep your money covered by FDIC insurance, keep your emergency fund safe from spending, and help you better track your goals.

How many bank accounts are too many : While having multiple accounts can have its perks, it can also lead to confusion and complicate your financial life. If you find it hard to keep track of all the accounts and their balances, it's best to stick to one or two accounts.

There's no one correct answer, but it's usually best to start with at least two accounts—a checking account and a savings account. This gives you an everyday banking account for bills and other expenses and another for saving. Your bank account journey doesn't need to end there.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

What percentage of people have multiple bank accounts

While about half of Americans have more than one bank account, 68 percent of those with $100,000 or more in savings have multiple accounts, according to market research firm YouGov. There are several ways that having multiple savings accounts can help make managing your personal finances easier.Average Savings By Age

Drawbacks of Having Multiple Bank Accounts

Fees: It's possible to find several bank accounts that don't charge monthly fees, but if you decide to choose banks or credit unions that charge them, it can get expensive fast. Organization: It's important to stay organized if you have more than one bank account.

If you're looking for a ballpark figure, Taylor Kovar, certified financial planner and CEO of Kovar Wealth Management says, “By age 30, a good rule of thumb is to aim to have saved the equivalent of your annual salary.

Should I keep all my money in one bank : Keeping all of your money in one bank can be convenient. But it's important to consider whether you're getting the best rates on savings and paying the lowest fees for checking accounts. It's possible that you could get a better deal by keeping some of your money at a different bank.

Is 7 bank accounts too many : You can have as many checking accounts as you want. Keeping track of multiple accounts is more complicated than a single checking account. However, opening and using multiple accounts can help you better manage your budget, cash flow, and other financial needs.

Is it smart to have two banks

Budgeting with multiple bank accounts could prove easier than with only one. Multiple accounts can help you separate spending money from savings and household money from individual earnings. Tracking savings goals. Having multiple bank accounts may help track individual savings goals more easily.

As long as that bank is FDIC-insured and your deposit doesn't exceed $250,000, you should be safe to do so. It might be worth it to maintain an account at a separate bank, however, just in case a bank error or accidental account freeze results in a loss of access to your money for a time.Aim to have three to six months' worth of expenses set aside. To figure out how much you should have saved for emergencies, simply multiply the amount of money you spend each month on expenses by either three or six months to get your target goal amount.

Is $3 million enough to retire at 40 : Summary. $3 million should be more than enough to fund your retirement, even if you choose to retire early. A number of factors are at play when determining how long $3 million will last, including your investment strategy and retirement lifestyle.