While not using your card can help your utilization, it may impact your account status. If you don't activate a credit card and thus don't use the card, your account may be closed. Card issuers typically close accounts that aren't used within a certain time period, usually over a year.If you already have an online bank account with the provider, then your credit card will have been added to your account. Simply log in and go through the activation steps. If you don't have an online account, you'll need to set one up, then log in and enter your personal information to activate your card.What if you didn't activate your card as soon as you got it If you don't activate a credit card within a certain timeframe and don't use it, your account may be closed automatically and be reported as 'closed by credit grantor', which could have a negative impact on your credit.

Will I be charged if I don’t activate my credit card : A credit card account opens from the moment of approval, not activation; activation lets the issuer know that the rightful card owner received the card. If a card has an annual fee, that charge will be on the billing statement regardless of whether you activate the card.

Do credit cards go inactive if you don’t use them

Not using a credit card regularly can cause the card to become inactive. If a credit card issuer deems your account to be inactive, it may close the account. However, closing unused credit card accounts can help protect your accounts from fraudulent charges.

Should we activate credit card : Once you receive your Credit Card, it is advisable to activate it promptly. Timely activation ensures that you can start using the card for online and offline transactions without unnecessary delays.

Call customer service: You can call the phone number on the back of your credit card to reach customer service. You'll be able to check the status of your card and, if it is deactivated, you can ask about reactivation. Make a purchase: Another way to check if a card is active is to try and use it to make a purchase. The first step in this journey is understanding how to activate a new Credit Card.

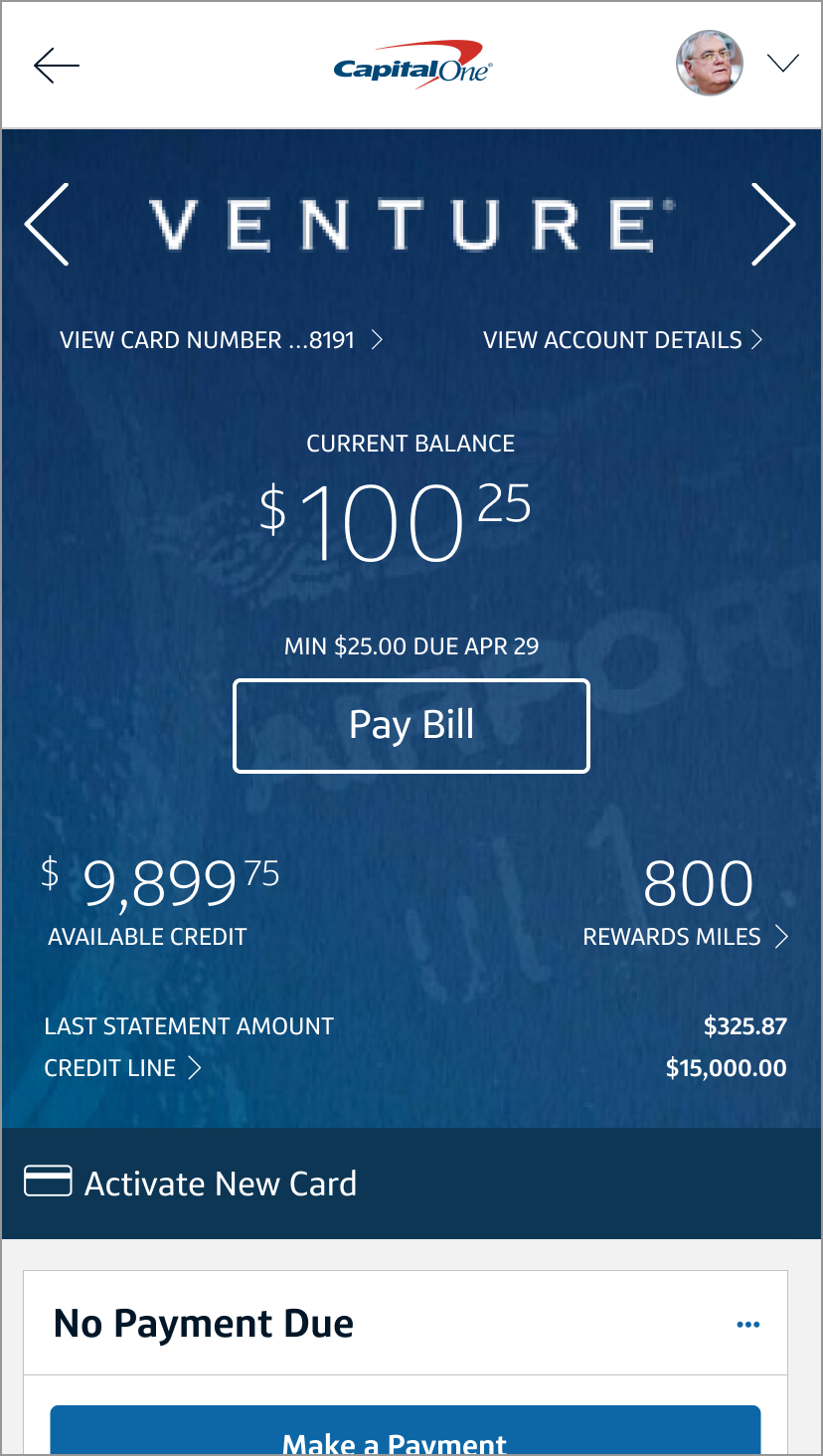

Online activation of Credit Card.

Activate your Credit Card via net banking.

Activating Credit Card via mobile app.

Call customer support to activate your Credit Card.

Activate your Credit Card offline.

Setting your Credit Card PIN.

Conclusion.

Is it bad to leave a credit card inactive

If you stop using the card altogether, there's a chance that your account will be closed (typically after at least 12 months of inactivity). This will appear on your credit report and could drop your score, so it's vital to keep your account active and make the payments needed to keep your account in good standing.If you do not activate your card, your credit card will be closed by your issuer and you cannot use it for any kind of transactions.Credit card inactivity will eventually result in your account being closed. A closed account can have a negative impact on your credit score, so consider keeping your cards open and active whenever possible. Your account is opened when your application is approved, so even if you don't activate the credit card you receive in the mail, you still have an open account and you'll still need to pay the annual fee associated with it. This applies to secured credit cards that come with fees as well.

Is it OK if I never use my credit card : Credit card inactivity will eventually result in your account being closed. A closed account can have a negative impact on your credit score, so consider keeping your cards open and active whenever possible.

How long do credit cards stay open without activity : If you stop using the card altogether, there's a chance that your account will be closed (typically after at least 12 months of inactivity). This will appear on your credit report and could drop your score, so it's vital to keep your account active and make the payments needed to keep your account in good standing.

What happens if I don’t activate my credit one card

You'll be unable to use your new credit card for purchases or other transactions until you activate it. Additionally, your account may be automatically closed if you don't activate your card within 14 days after you receive it in the mail. You can easily activate your credit card by reaching out to the bank's customer care service. Once you contact the bank's customer support department, they will guide you in activating your credit card. You can visit the bank's official website to find the customer care numbers.Activating a new credit card can be done with a simple phone call. Typically, a sticker on the front of your new card will feature a phone number. You may be required to speak to a representative or navigate an automated phone tree.

Can I start using my credit card immediately : The bottom line

Approval for a traditional credit card often means waiting for up to 10 days before you can receive and use a physical card. Yet many card issuers are offering a way around the wait with instant-use credit cards that allow you to use your account and take advantage of cardholder benefits right away.

Antwort Do I need to activate my credit card? Weitere Antworten – Does my credit card need to be activated

While not using your card can help your utilization, it may impact your account status. If you don't activate a credit card and thus don't use the card, your account may be closed. Card issuers typically close accounts that aren't used within a certain time period, usually over a year.If you already have an online bank account with the provider, then your credit card will have been added to your account. Simply log in and go through the activation steps. If you don't have an online account, you'll need to set one up, then log in and enter your personal information to activate your card.What if you didn't activate your card as soon as you got it If you don't activate a credit card within a certain timeframe and don't use it, your account may be closed automatically and be reported as 'closed by credit grantor', which could have a negative impact on your credit.

Will I be charged if I don’t activate my credit card : A credit card account opens from the moment of approval, not activation; activation lets the issuer know that the rightful card owner received the card. If a card has an annual fee, that charge will be on the billing statement regardless of whether you activate the card.

Do credit cards go inactive if you don’t use them

Not using a credit card regularly can cause the card to become inactive. If a credit card issuer deems your account to be inactive, it may close the account. However, closing unused credit card accounts can help protect your accounts from fraudulent charges.

Should we activate credit card : Once you receive your Credit Card, it is advisable to activate it promptly. Timely activation ensures that you can start using the card for online and offline transactions without unnecessary delays.

Call customer service: You can call the phone number on the back of your credit card to reach customer service. You'll be able to check the status of your card and, if it is deactivated, you can ask about reactivation. Make a purchase: Another way to check if a card is active is to try and use it to make a purchase.

The first step in this journey is understanding how to activate a new Credit Card.

Is it bad to leave a credit card inactive

If you stop using the card altogether, there's a chance that your account will be closed (typically after at least 12 months of inactivity). This will appear on your credit report and could drop your score, so it's vital to keep your account active and make the payments needed to keep your account in good standing.If you do not activate your card, your credit card will be closed by your issuer and you cannot use it for any kind of transactions.Credit card inactivity will eventually result in your account being closed. A closed account can have a negative impact on your credit score, so consider keeping your cards open and active whenever possible.

Your account is opened when your application is approved, so even if you don't activate the credit card you receive in the mail, you still have an open account and you'll still need to pay the annual fee associated with it. This applies to secured credit cards that come with fees as well.

Is it OK if I never use my credit card : Credit card inactivity will eventually result in your account being closed. A closed account can have a negative impact on your credit score, so consider keeping your cards open and active whenever possible.

How long do credit cards stay open without activity : If you stop using the card altogether, there's a chance that your account will be closed (typically after at least 12 months of inactivity). This will appear on your credit report and could drop your score, so it's vital to keep your account active and make the payments needed to keep your account in good standing.

What happens if I don’t activate my credit one card

You'll be unable to use your new credit card for purchases or other transactions until you activate it. Additionally, your account may be automatically closed if you don't activate your card within 14 days after you receive it in the mail.

You can easily activate your credit card by reaching out to the bank's customer care service. Once you contact the bank's customer support department, they will guide you in activating your credit card. You can visit the bank's official website to find the customer care numbers.Activating a new credit card can be done with a simple phone call. Typically, a sticker on the front of your new card will feature a phone number. You may be required to speak to a representative or navigate an automated phone tree.

Can I start using my credit card immediately : The bottom line

Approval for a traditional credit card often means waiting for up to 10 days before you can receive and use a physical card. Yet many card issuers are offering a way around the wait with instant-use credit cards that allow you to use your account and take advantage of cardholder benefits right away.