Both Silicon Valley Bank and SVB Private were placed in receivership and sold to First Citizens Bank. SVB Securities was sold to its management in July 2023 and renamed Leerink Partners. SVB Capital was sold in May 2024 to a newly formed entity affiliated with Pinegrove Capital Partners.Net assets on the balance sheet as of December 2022 : $16.29 B.Pinegrove Capital Partners

SVB Financial Group has entered into a definitive agreement to sell its investment platform business, SVB Capital. The buyer is a newly created entity affiliated with Pinegrove Capital Partners and backed by Brookfield Asset Management and Sequoia Heritage, SVB Financial Group said in a Thursday (May 2) press release.

Who owns First Citizens Bank : First Citizens BancShares Inc (Delaware)First Citizens BancShares / Parent organization

First-Citizens Bank & Trust Company, known as First Citizens Bank, is a North Carolina state-chartered commercial bank and a wholly owned subsidiary of First Citizens BancShares, Inc.

Are SVB accounts still active

Silicon Valley Bank (SVB) was shut down in March 2023 by the California Department of Financial Protection and Innovation. Based in Santa Clara, California, the bank was shut down after its investments greatly decreased in value and its depositors withdrew large amounts of money, among other factors.

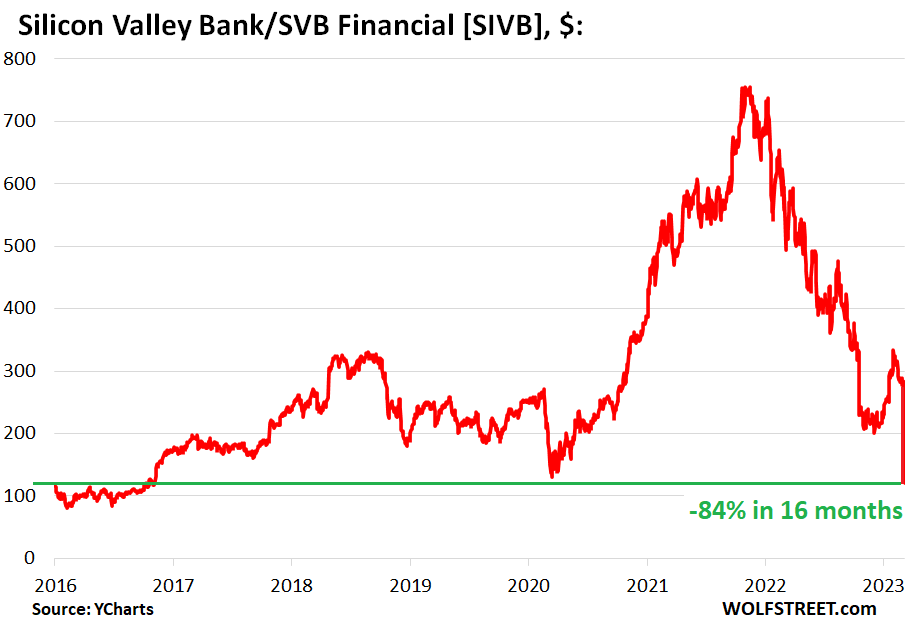

Can you still buy SVB shares : SVB Financial Group's subsidiary Silicon Valley Bank is the poster child of bank failures in the 2020s. Still, you can still have fun trading the company's shares — and, if you're lucky, book profits along the way — as long as you exercise due caution.

Silicon Valley Bank invested a large amount of bank deposits in long-term U.S. treasuries and agency mortgage-backed securities. However, bonds and treasury values fall when interest rates increase. When the Federal Reserve hiked interest rates in 2022 to combat inflation, SVB's bond portfolio started to drop. CEO Greg Becker exercised stock options — meaning he paid money to convert his options into stock — and then immediately sold the stock on Feb. 27, filings show. That netted him $2.27 million in personal profits.

Is Silicon Valley Bank safe now

Silicon Valley Bank (SVB)—the 16th largest bank in the United States—was shut down by federal regulators on March 10, 2023. In the aftermath of the collapse, federal regulators promised to make all depositors whole, even for those funds that weren't protected by the Federal Deposit Insurance Corporation (FDIC).First Citizens BancSharesSilicon Valley Bank / Parent organization

It's under new management, and now owned by North Carolina-based First Citizens Bank, which bought its deposits and branches out of bankruptcy weeks after SVB crumbled in March 2023.Frank Holding Jr. and his extended family have seen the value of their stake double to about $2.2 billion after buying Silicon Valley Bank's assets out of bankruptcy. The FDIC will commence a liquidation process of assets that SVB valued at more than $200 billion — but the actual dollar amount those assets fetch is likely to be less. "Uninsured depositors will get a recovery, and may even get a full recovery, but that will happen at some point in the future," Ricks said.

What happens to SVB deposits now : Your deposits will continue to be insured by the FDIC up to the maximum amount allowed by law. This maximum amount is $250,000 per depositor, per insured bank, for each account ownership category.

Is SVB stock now worthless : Since shares in neither SVB nor Signature Bank are still being traded and the institutions no longer exist, the shares are assumed to be worthless. Taxpayers who hold worthless securities are generally allowed to claim a capital loss in the year the asset becomes worthless.

Will SVB shareholders get their money back

While it is unlikely SIVB common shareholders get a recovery, holders of SVB Financial Group notes may get a significant recovery, if not a full recovery, from cash and the sale of the bank's parent company's remaining assets under a Ch. 11 reorganization plan. However, the Treasury Department, the Federal Reserve, and the FDIC announced they would make sure all depositors with accounts at SVB and Signature Bank would have access to their funds by the next day – beyond just the $250,000 guaranteed by the FDIC.Goldman Sachs acted as both the buyer of SVB-held bonds and the architect of failed efforts to raise capital for the bank, raking in profits and fees even as SVB was seized by the Federal Deposit Insurance Corporation (FDIC) in a failure that cost the Federal Deposit Insurance Fund $20 billion and caused 'macro ripples …

Did SVB get their money back : 16. March 12: Federal regulators announce emergency measures in response to the Silicon Valley Bank failure, allowing customers to recover all funds, including those that were uninsured.

Antwort Did SVB lose all of its money? Weitere Antworten – Does the SVB Financial Group still exist

Both Silicon Valley Bank and SVB Private were placed in receivership and sold to First Citizens Bank. SVB Securities was sold to its management in July 2023 and renamed Leerink Partners. SVB Capital was sold in May 2024 to a newly formed entity affiliated with Pinegrove Capital Partners.Net assets on the balance sheet as of December 2022 : $16.29 B.Pinegrove Capital Partners

SVB Financial Group has entered into a definitive agreement to sell its investment platform business, SVB Capital. The buyer is a newly created entity affiliated with Pinegrove Capital Partners and backed by Brookfield Asset Management and Sequoia Heritage, SVB Financial Group said in a Thursday (May 2) press release.

Who owns First Citizens Bank : First Citizens BancShares Inc (Delaware)First Citizens BancShares / Parent organization

First-Citizens Bank & Trust Company, known as First Citizens Bank, is a North Carolina state-chartered commercial bank and a wholly owned subsidiary of First Citizens BancShares, Inc.

Are SVB accounts still active

Silicon Valley Bank (SVB) was shut down in March 2023 by the California Department of Financial Protection and Innovation. Based in Santa Clara, California, the bank was shut down after its investments greatly decreased in value and its depositors withdrew large amounts of money, among other factors.

Can you still buy SVB shares : SVB Financial Group's subsidiary Silicon Valley Bank is the poster child of bank failures in the 2020s. Still, you can still have fun trading the company's shares — and, if you're lucky, book profits along the way — as long as you exercise due caution.

Silicon Valley Bank invested a large amount of bank deposits in long-term U.S. treasuries and agency mortgage-backed securities. However, bonds and treasury values fall when interest rates increase. When the Federal Reserve hiked interest rates in 2022 to combat inflation, SVB's bond portfolio started to drop.

CEO Greg Becker exercised stock options — meaning he paid money to convert his options into stock — and then immediately sold the stock on Feb. 27, filings show. That netted him $2.27 million in personal profits.

Is Silicon Valley Bank safe now

Silicon Valley Bank (SVB)—the 16th largest bank in the United States—was shut down by federal regulators on March 10, 2023. In the aftermath of the collapse, federal regulators promised to make all depositors whole, even for those funds that weren't protected by the Federal Deposit Insurance Corporation (FDIC).First Citizens BancSharesSilicon Valley Bank / Parent organization

It's under new management, and now owned by North Carolina-based First Citizens Bank, which bought its deposits and branches out of bankruptcy weeks after SVB crumbled in March 2023.Frank Holding Jr. and his extended family have seen the value of their stake double to about $2.2 billion after buying Silicon Valley Bank's assets out of bankruptcy.

The FDIC will commence a liquidation process of assets that SVB valued at more than $200 billion — but the actual dollar amount those assets fetch is likely to be less. "Uninsured depositors will get a recovery, and may even get a full recovery, but that will happen at some point in the future," Ricks said.

What happens to SVB deposits now : Your deposits will continue to be insured by the FDIC up to the maximum amount allowed by law. This maximum amount is $250,000 per depositor, per insured bank, for each account ownership category.

Is SVB stock now worthless : Since shares in neither SVB nor Signature Bank are still being traded and the institutions no longer exist, the shares are assumed to be worthless. Taxpayers who hold worthless securities are generally allowed to claim a capital loss in the year the asset becomes worthless.

Will SVB shareholders get their money back

While it is unlikely SIVB common shareholders get a recovery, holders of SVB Financial Group notes may get a significant recovery, if not a full recovery, from cash and the sale of the bank's parent company's remaining assets under a Ch. 11 reorganization plan.

However, the Treasury Department, the Federal Reserve, and the FDIC announced they would make sure all depositors with accounts at SVB and Signature Bank would have access to their funds by the next day – beyond just the $250,000 guaranteed by the FDIC.Goldman Sachs acted as both the buyer of SVB-held bonds and the architect of failed efforts to raise capital for the bank, raking in profits and fees even as SVB was seized by the Federal Deposit Insurance Corporation (FDIC) in a failure that cost the Federal Deposit Insurance Fund $20 billion and caused 'macro ripples …

Did SVB get their money back : 16. March 12: Federal regulators announce emergency measures in response to the Silicon Valley Bank failure, allowing customers to recover all funds, including those that were uninsured.