CPI maintains an excellent relationship with our current auditor EY, but encourages and invites all eligible audit firms to participate in the tender.Radovan Vítek is the founder and majority shareholder of the company, holding approximately 88.8% of CPIPG's share capital and 89.4% (as of 31 December 2021) of voting rights directly and through vehicles controlled by him.David Greenbaum

David Greenbaum was appointed CEO of CPI Property Group in November 2023.

Who is CPI owned by : The Jordan Company

Shaping the Future Through Innovation and Discovery. Today, CPI is a global communications and defense technology company and is owned by The Jordan Company.

How does CPI work

The Consumer Price Index or CPI measures the overall change in the prices of goods and services that people typically buy over time. It does this by collecting approximately 53,000 prices every month and comparing these to the corresponding prices from the previous month.

How to trade CPI in forex : How to trade on CPI Traders compare the forecast with the actual CPI data, which you can check in the economic calendar. If the actual CPI data is greater than expectations, the currency will rise. If the actual CPI data is lower than forecasted, the currency will drop.

How to trade on CPI Traders compare the forecast with the actual CPI data, which you can check in the economic calendar. If the actual CPI data is greater than expectations, the currency will rise. If the actual CPI data is lower than forecasted, the currency will drop. higher inflation

When the CPI is rising it means that consumer prices are also rising, and when it falls it means consumer prices are generally falling. In short, a higher CPI indicates higher inflation, while a falling CPI indicates lower inflation, or even deflation.

Is high CPI good or bad

Is a lower CPI figure good for markets, or a higher figure When the CPI is rising it means that consumer prices are also rising, and when it falls it means consumer prices are generally falling. In short, a higher CPI indicates higher inflation, while a falling CPI indicates lower inflation, or even deflation.Higher inflation in the form of a higher CPI naturally makes an individual unit of currency worth less, as there are more units of that currency needed to buy a given item.Is a lower CPI figure good for markets, or a higher figure When the CPI is rising it means that consumer prices are also rising, and when it falls it means consumer prices are generally falling. In short, a higher CPI indicates higher inflation, while a falling CPI indicates lower inflation, or even deflation. We can go to the Bureau of Labor Statistics to find the CPI-U for the relevant periods. The formula below calculates the real value of past dollars in more recent dollars: Past dollars in terms of recent dollars = Dollar amount × Ending-period CPI ÷ Beginning-period CPI.

Is higher CPI bullish : It is a key way to measure changes in purchasing trends and inflation. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Is high CPI good or bad for currency : We now know that a positive CPI adds value to currency and a negative CPI causes it to lose value. Trading CFDs with AvaTrade, we can benefit from either direction! No restrictions on short selling apply.

Is high CPI bullish or bearish

It is a key way to measure changes in purchasing trends and inflation. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD. Is a lower CPI figure good for markets, or a higher figure When the CPI is rising it means that consumer prices are also rising, and when it falls it means consumer prices are generally falling. In short, a higher CPI indicates higher inflation, while a falling CPI indicates lower inflation, or even deflation.The Consumer Price Index (CPI) is a critical indicator of pricing pressures in an economy and provides a gauge of inflation. Forex traders monitor the CPI, as it can lead to changes in monetary policy by the central bank that will either strengthen or weaken the currency against rivals in the markets.

What will $1 be worth in 30 years : Real growth rates

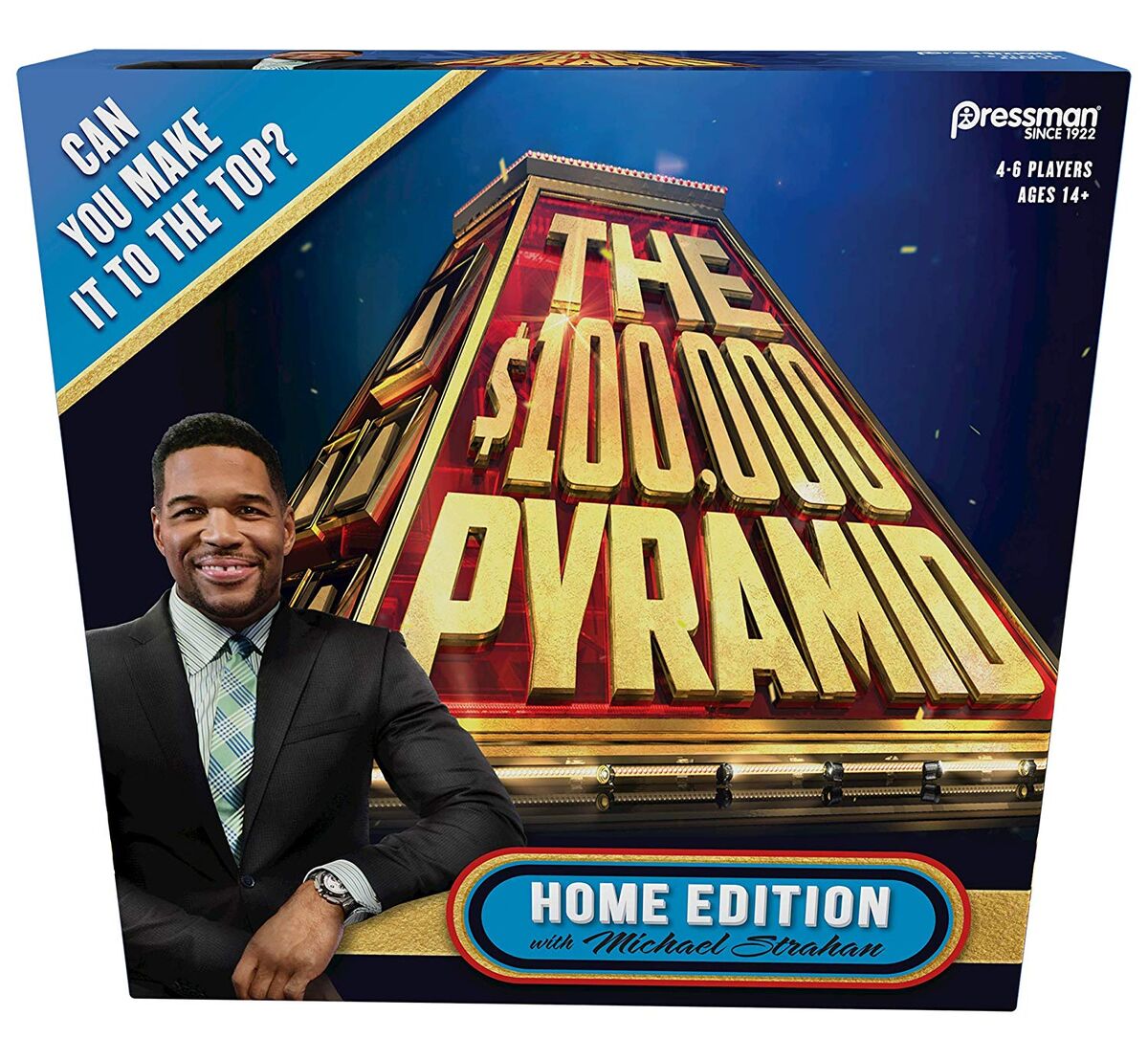

Antwort Can you win $150,000 on $100,000 Pyramid? Weitere Antworten – Who is the auditor of the CPI property group

CPI maintains an excellent relationship with our current auditor EY, but encourages and invites all eligible audit firms to participate in the tender.Radovan Vítek is the founder and majority shareholder of the company, holding approximately 88.8% of CPIPG's share capital and 89.4% (as of 31 December 2021) of voting rights directly and through vehicles controlled by him.David Greenbaum

David Greenbaum was appointed CEO of CPI Property Group in November 2023.

Who is CPI owned by : The Jordan Company

Shaping the Future Through Innovation and Discovery. Today, CPI is a global communications and defense technology company and is owned by The Jordan Company.

How does CPI work

The Consumer Price Index or CPI measures the overall change in the prices of goods and services that people typically buy over time. It does this by collecting approximately 53,000 prices every month and comparing these to the corresponding prices from the previous month.

How to trade CPI in forex : How to trade on CPI Traders compare the forecast with the actual CPI data, which you can check in the economic calendar. If the actual CPI data is greater than expectations, the currency will rise. If the actual CPI data is lower than forecasted, the currency will drop.

How to trade on CPI Traders compare the forecast with the actual CPI data, which you can check in the economic calendar. If the actual CPI data is greater than expectations, the currency will rise. If the actual CPI data is lower than forecasted, the currency will drop.

higher inflation

When the CPI is rising it means that consumer prices are also rising, and when it falls it means consumer prices are generally falling. In short, a higher CPI indicates higher inflation, while a falling CPI indicates lower inflation, or even deflation.

Is high CPI good or bad

Is a lower CPI figure good for markets, or a higher figure When the CPI is rising it means that consumer prices are also rising, and when it falls it means consumer prices are generally falling. In short, a higher CPI indicates higher inflation, while a falling CPI indicates lower inflation, or even deflation.Higher inflation in the form of a higher CPI naturally makes an individual unit of currency worth less, as there are more units of that currency needed to buy a given item.Is a lower CPI figure good for markets, or a higher figure When the CPI is rising it means that consumer prices are also rising, and when it falls it means consumer prices are generally falling. In short, a higher CPI indicates higher inflation, while a falling CPI indicates lower inflation, or even deflation.

We can go to the Bureau of Labor Statistics to find the CPI-U for the relevant periods. The formula below calculates the real value of past dollars in more recent dollars: Past dollars in terms of recent dollars = Dollar amount × Ending-period CPI ÷ Beginning-period CPI.

Is higher CPI bullish : It is a key way to measure changes in purchasing trends and inflation. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Is high CPI good or bad for currency : We now know that a positive CPI adds value to currency and a negative CPI causes it to lose value. Trading CFDs with AvaTrade, we can benefit from either direction! No restrictions on short selling apply.

Is high CPI bullish or bearish

It is a key way to measure changes in purchasing trends and inflation. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Is a lower CPI figure good for markets, or a higher figure When the CPI is rising it means that consumer prices are also rising, and when it falls it means consumer prices are generally falling. In short, a higher CPI indicates higher inflation, while a falling CPI indicates lower inflation, or even deflation.The Consumer Price Index (CPI) is a critical indicator of pricing pressures in an economy and provides a gauge of inflation. Forex traders monitor the CPI, as it can lead to changes in monetary policy by the central bank that will either strengthen or weaken the currency against rivals in the markets.

What will $1 be worth in 30 years : Real growth rates