A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.Shelton NASDAQ-100 Index Direct (NASDX)

Overview: The Shelton Nasdaq-100 Index Direct ETF tracks the performance of the largest non-financial companies in the Nasdaq-100 Index, which includes primarily tech companies. This mutual fund began trading in 2000 and has a strong record over the last five and ten years.

Is NAS100 the same as Nasdaq : The Nasdaq-100 is often abbreviated as NDX, NDQ, NAS100 or US100 in the derivatives markets. Its corresponding futures contracts are traded on the Chicago Mercantile Exchange. The regular futures are denoted by the Reuters Instrument Code ND, and the smaller E-mini version uses the code NQ.

Can I buy 1 share of Nasdaq

There is no minimum amount of shares you must purchase when buying stocks, however, considering broker commissions and fees, most people are best off buying a minimum of $500-1000 worth of shares when investing.

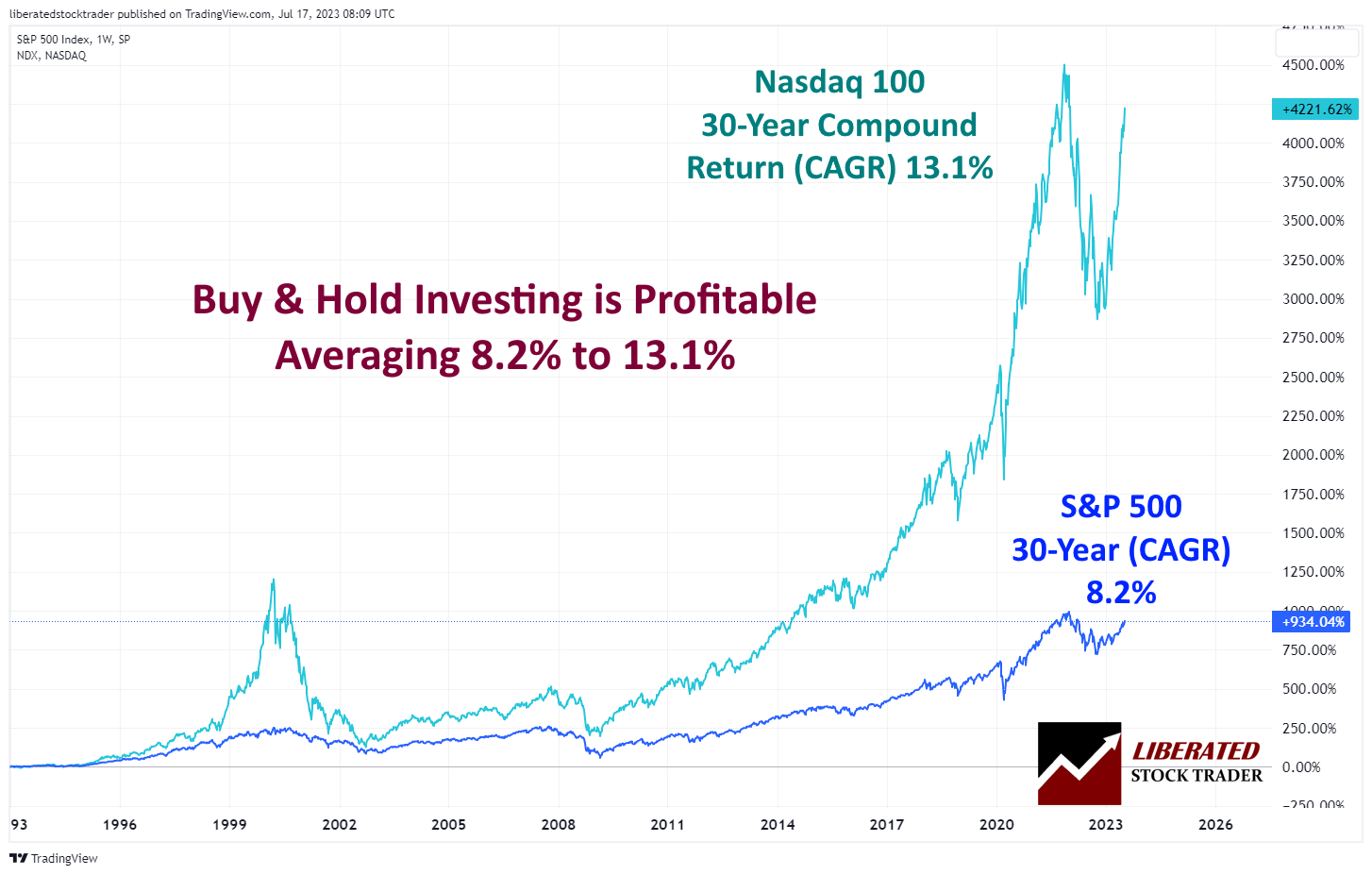

Is it risky to invest in Nasdaq : It's safe to invest in the stocks that make up the Nasdaq 100 — as long as you have a long time horizon. Historically, the Nasdaq 100 has smashed the S&P 500 in terms of returns. But tech stocks tend to be more volatile than the overall stock market and perform especially poorly during recessions.

In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices. Looking at the 55% eye-popping returns in 2023, many Indian investors are looking at ways of investing in the NASDAQ out of sheer FOMO (Fear of Missing Out).

About half of the NASDAQ index does not pay a dividend. The companies that do offer shareholders a dividend tend to offer low yielding dividends. In comparison, the S&P 500 has over 400 companies that pay dividends and all 30 components of the Dow pay a dividend. Here is an overview of the NASDAQ dividend yield.

Is Nasdaq part of S&P 500

The S&P 500, the Dow, and the Nasdaq Composite are different indexes used to track market performance. Even though they have different pedigrees, inclusion criteria, and sectoral composition, the indexes generally move in the same direction.The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco. The European counterpart of this ETF uses the ticker symbol eQQQ.The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges. The index includes companies in basic materials, consumer discretionary spending, consumer staples, healthcare, industrials, technology, telecommunications, and utilities.

The NASDAQ Composite is an equity index that includes most stocks listed on the NASDAQ stock market. Together with the DJIA (Dow Jones Industrial Average) and the SPX500 (Standard & Poor's 500) indices, the NASDAQ Composite is one of the three most popular equity indices traded in the United States.

Is 100 shares a lot : A lot is amount of securities bought in a single transaction on an exchange. A round lot is typically 100 shares but investors don't have to buy in round lots. Bunching is the combining of small or unusually-sized trade orders for the same security into one large order for simultaneous execution.

What happens if a Nasdaq stock goes below $1 : If a company trades for 30 consecutive business days below the $1.00 minimum closing bid price requirement, Nasdaq will send a deficiency notice to the company, advising that it has been afforded a "compliance period" of 180 calendar days to regain compliance with the applicable requirements.

How much is 1 lot of Nasdaq 100

100,000 units

While 1 lot represents a transaction of 100,000 units of the currency mentioned first in a currency pair, the value of 1 micro lot is 1,000 units. If you are interested in the relationship between lots, micro-lots, leverage, and margin, we recommend reading the article about micro-lots we wrote on the subject.

The Nasdaq-100® is one of the world's preeminent large-cap growth indexes.Simply put, 100% stock dividend is 1:1 or 1 for 1 bonus share, as explained above, if you held 100 shares after 1:1 bonus you would have 200 shares (100 original, another 100 as bonus). The impact on the stock price is that the price becomes 1/2 the price of the stock before bonus (supply has doubled).

How do I invest in the S&P 500 : The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

Antwort Can you put money in Nasdaq? Weitere Antworten – Can you invest in the Nasdaq

A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.Shelton NASDAQ-100 Index Direct (NASDX)

Overview: The Shelton Nasdaq-100 Index Direct ETF tracks the performance of the largest non-financial companies in the Nasdaq-100 Index, which includes primarily tech companies. This mutual fund began trading in 2000 and has a strong record over the last five and ten years.

Is NAS100 the same as Nasdaq : The Nasdaq-100 is often abbreviated as NDX, NDQ, NAS100 or US100 in the derivatives markets. Its corresponding futures contracts are traded on the Chicago Mercantile Exchange. The regular futures are denoted by the Reuters Instrument Code ND, and the smaller E-mini version uses the code NQ.

Can I buy 1 share of Nasdaq

There is no minimum amount of shares you must purchase when buying stocks, however, considering broker commissions and fees, most people are best off buying a minimum of $500-1000 worth of shares when investing.

Is it risky to invest in Nasdaq : It's safe to invest in the stocks that make up the Nasdaq 100 — as long as you have a long time horizon. Historically, the Nasdaq 100 has smashed the S&P 500 in terms of returns. But tech stocks tend to be more volatile than the overall stock market and perform especially poorly during recessions.

In 2023, the NASDAQ 100 Index gave stellar returns of 55%, making it one of the best-performing indices amongst major global indices. Looking at the 55% eye-popping returns in 2023, many Indian investors are looking at ways of investing in the NASDAQ out of sheer FOMO (Fear of Missing Out).

About half of the NASDAQ index does not pay a dividend. The companies that do offer shareholders a dividend tend to offer low yielding dividends. In comparison, the S&P 500 has over 400 companies that pay dividends and all 30 components of the Dow pay a dividend. Here is an overview of the NASDAQ dividend yield.

Is Nasdaq part of S&P 500

The S&P 500, the Dow, and the Nasdaq Composite are different indexes used to track market performance. Even though they have different pedigrees, inclusion criteria, and sectoral composition, the indexes generally move in the same direction.The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco. The European counterpart of this ETF uses the ticker symbol eQQQ.The Nasdaq 100 Index is a stock index of the 100 largest companies by modified market capitalization trading on Nasdaq exchanges. The index includes companies in basic materials, consumer discretionary spending, consumer staples, healthcare, industrials, technology, telecommunications, and utilities.

The NASDAQ Composite is an equity index that includes most stocks listed on the NASDAQ stock market. Together with the DJIA (Dow Jones Industrial Average) and the SPX500 (Standard & Poor's 500) indices, the NASDAQ Composite is one of the three most popular equity indices traded in the United States.

Is 100 shares a lot : A lot is amount of securities bought in a single transaction on an exchange. A round lot is typically 100 shares but investors don't have to buy in round lots. Bunching is the combining of small or unusually-sized trade orders for the same security into one large order for simultaneous execution.

What happens if a Nasdaq stock goes below $1 : If a company trades for 30 consecutive business days below the $1.00 minimum closing bid price requirement, Nasdaq will send a deficiency notice to the company, advising that it has been afforded a "compliance period" of 180 calendar days to regain compliance with the applicable requirements.

How much is 1 lot of Nasdaq 100

100,000 units

While 1 lot represents a transaction of 100,000 units of the currency mentioned first in a currency pair, the value of 1 micro lot is 1,000 units. If you are interested in the relationship between lots, micro-lots, leverage, and margin, we recommend reading the article about micro-lots we wrote on the subject.

The Nasdaq-100® is one of the world's preeminent large-cap growth indexes.Simply put, 100% stock dividend is 1:1 or 1 for 1 bonus share, as explained above, if you held 100 shares after 1:1 bonus you would have 200 shares (100 original, another 100 as bonus). The impact on the stock price is that the price becomes 1/2 the price of the stock before bonus (supply has doubled).

How do I invest in the S&P 500 : The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.