The fifty percent principle is a rule of thumb that anticipates the size of a technical correction. The fifty percent principle states that when a stock or other asset begins to fall after a period of rapid gains, it will lose at least 50% of its most recent gains before the price begins advancing again.Stocks are much more variable (or volatile) because they depend on the performance of the company. Thus, they are much riskier than bonds. When you buy a stock, it is hard to estimate what return you will receive over time (if any). Nonetheless, the greater the risk, the greater the return.5% Rule: This rule applies to the total risk exposure across all your open trades. It recommends limiting the total risk exposure of all your trades combined to no more than 5% of your trading capital. This means if you have multiple trades open simultaneously, their combined risk should not exceed 5%.

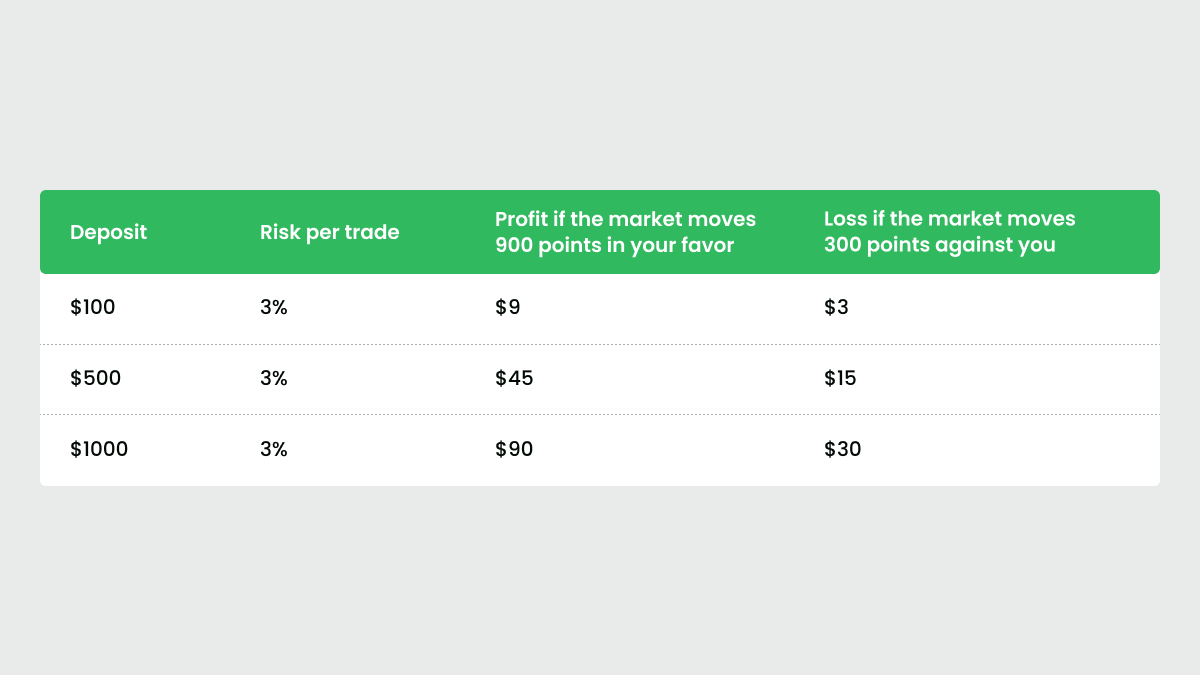

What is the 3% rule in trading : The 3% rule states that you should never risk more than 3% of your whole trading capital on a single deal. In order to safeguard themselves against big losses, traders attempt to restrict exposures on a single deal.

Can I risk 3% per trade

A trader should only use leverage when the advantage is clearly on their side. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. As a general rule, this loss should never be more than 3% of trading capital.

How much can I risk per trade : Risk per trade should always be a small percentage of your total capital. A good starting percentage could be 2% of your available trading capital. So, for example, if you have $5000 in your account, the maximum loss allowable should be no more than 2%. With these parameters, your maximum loss would be $100 per trade.

Always calculate your maximum risk per trade: Generally, risking under 2% of your total trading capital per trade is considered sensible. Anything over 5% is usually considered high risk. This is a rule that aims to aid diversification in an investment portfolio. It states that one should not hold more than 5% of the total value of the portfolio in a single security.

What is the 3day rule in trading

What Is the 3-Day Rule in Stock Trading The 3-Day Rule is an informal strategy suggesting that investors should wait three days after a significant drop in a stock's price before buying shares.A good rule of thumb is to risk between 1% and 5% of your account balance per trade.You'll find some guidance that says don't risk more than 1% of your trading capital per trade, while others say it's ok to go up to 10%. Most traders agree not to go much higher than that though, and here's why… With 2% risk per trade, even after 15 losses you've lost less than 25% of your trading capital. If you know that the next trade will come up in a few days, you can probably bump your risk a little. But don't go too crazy, in general, the rule of thumb is that the risk per trade should not be over 5%, an exception to this could be if you are taking a long term investment.

Is 5 percent per trade good : Yes it's good. But to trade profitably over the long term the key question is ; How much did l risk in this trade v how much was my reward Knowing risk to reward ratios per trade is key : If you had 1% at risk versus a 5 % target then this was a very good trade.

What is the 5 percent rule in trading : The 5% rule says as an investor, you should not invest more than 5% of your total portfolio in any one option alone. This simple technique will ensure you have a balanced portfolio.

What is the 5% policy

It dates back to 1943 and states that commissions, markups, and markdowns of more than 5% are prohibited on standard trades, including over-the-counter and stock exchange listings, cash sales, and riskless transactions. Financial Industry Regulatory Authority (FINRA). The 4% rule presumes half of your retirement savings is held in stocks for the entirety of your retirement, while the other half comprises bonds and other fixed-income investments. The rule also assumes you'll achieve average returns on both categories of assets.It is a high-stakes game where many are lured by the promise of quick riches but ultimately face harsh realities. One of the harsh realities of trading is the “Rule of 90,” which suggests that 90% of new traders lose 90% of their starting capital within 90 days of their first trade.

Can I risk 10% per trade : Lesson summary. Always calculate your maximum risk per trade: Generally, risking under 2% of your total trading capital per trade is considered sensible. Anything over 5% is usually considered high risk.

Antwort Can I risk 5% per trade? Weitere Antworten – What is the 50% rule in trading

The fifty percent principle is a rule of thumb that anticipates the size of a technical correction. The fifty percent principle states that when a stock or other asset begins to fall after a period of rapid gains, it will lose at least 50% of its most recent gains before the price begins advancing again.Stocks are much more variable (or volatile) because they depend on the performance of the company. Thus, they are much riskier than bonds. When you buy a stock, it is hard to estimate what return you will receive over time (if any). Nonetheless, the greater the risk, the greater the return.5% Rule: This rule applies to the total risk exposure across all your open trades. It recommends limiting the total risk exposure of all your trades combined to no more than 5% of your trading capital. This means if you have multiple trades open simultaneously, their combined risk should not exceed 5%.

What is the 3% rule in trading : The 3% rule states that you should never risk more than 3% of your whole trading capital on a single deal. In order to safeguard themselves against big losses, traders attempt to restrict exposures on a single deal.

Can I risk 3% per trade

A trader should only use leverage when the advantage is clearly on their side. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. As a general rule, this loss should never be more than 3% of trading capital.

How much can I risk per trade : Risk per trade should always be a small percentage of your total capital. A good starting percentage could be 2% of your available trading capital. So, for example, if you have $5000 in your account, the maximum loss allowable should be no more than 2%. With these parameters, your maximum loss would be $100 per trade.

Always calculate your maximum risk per trade: Generally, risking under 2% of your total trading capital per trade is considered sensible. Anything over 5% is usually considered high risk.

This is a rule that aims to aid diversification in an investment portfolio. It states that one should not hold more than 5% of the total value of the portfolio in a single security.

What is the 3day rule in trading

What Is the 3-Day Rule in Stock Trading The 3-Day Rule is an informal strategy suggesting that investors should wait three days after a significant drop in a stock's price before buying shares.A good rule of thumb is to risk between 1% and 5% of your account balance per trade.You'll find some guidance that says don't risk more than 1% of your trading capital per trade, while others say it's ok to go up to 10%. Most traders agree not to go much higher than that though, and here's why… With 2% risk per trade, even after 15 losses you've lost less than 25% of your trading capital.

If you know that the next trade will come up in a few days, you can probably bump your risk a little. But don't go too crazy, in general, the rule of thumb is that the risk per trade should not be over 5%, an exception to this could be if you are taking a long term investment.

Is 5 percent per trade good : Yes it's good. But to trade profitably over the long term the key question is ; How much did l risk in this trade v how much was my reward Knowing risk to reward ratios per trade is key : If you had 1% at risk versus a 5 % target then this was a very good trade.

What is the 5 percent rule in trading : The 5% rule says as an investor, you should not invest more than 5% of your total portfolio in any one option alone. This simple technique will ensure you have a balanced portfolio.

What is the 5% policy

It dates back to 1943 and states that commissions, markups, and markdowns of more than 5% are prohibited on standard trades, including over-the-counter and stock exchange listings, cash sales, and riskless transactions. Financial Industry Regulatory Authority (FINRA).

The 4% rule presumes half of your retirement savings is held in stocks for the entirety of your retirement, while the other half comprises bonds and other fixed-income investments. The rule also assumes you'll achieve average returns on both categories of assets.It is a high-stakes game where many are lured by the promise of quick riches but ultimately face harsh realities. One of the harsh realities of trading is the “Rule of 90,” which suggests that 90% of new traders lose 90% of their starting capital within 90 days of their first trade.

Can I risk 10% per trade : Lesson summary. Always calculate your maximum risk per trade: Generally, risking under 2% of your total trading capital per trade is considered sensible. Anything over 5% is usually considered high risk.