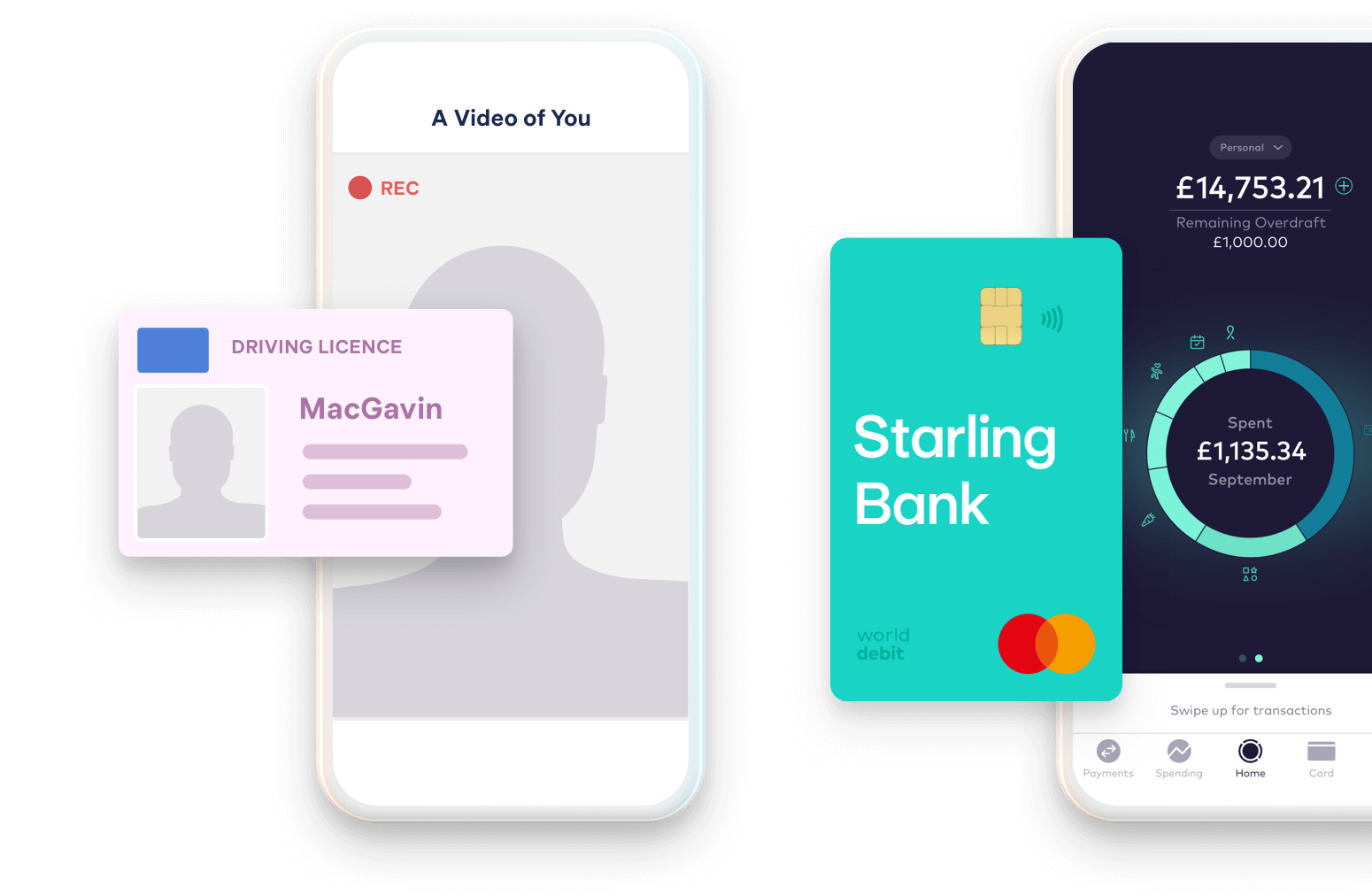

proof of ID, like your passport, driving license or national ID.

proof of address, like a bank statement or utility bill.

additional documents, subject to qualification status, local laws and regulations.

Generally foreign or offshore bank accounts will split into different account types, depending on customer needs. If you're a legal resident overseas with a valid visa and local address you'll usually be able to open the same selection of accounts anyone else would in your new country.Having a checking account can be a way to build a solid foundation for your financial life in the U.S. Some non-residents sometimes believe they're ineligible to open a bank account in this country. Fortunately, that isn't true. Many financial institutions offer U.S. bank accounts for non-residents.

How to open a bank account in Czech Republic : Two official identification documents, including: ID card, birth certificate, health insurance card, passport, proof of address, driving license or employee identification card. If you're a student and want to establish a student account, the bank will require a certificate of study or visa for the Czech Republic.

Which USA bank is for international

Citibank. Citibank is one of the best international banks in the US for expat banking because of their very international model. It currently physically operates in 97 markets 2, supporting clients from more than 160 countries, making access to their ATMs more convenient.

Can I open a bank account online without going to the bank USA : You'll usually find you can open a US bank account online if you're a legal US resident aged 18 or over, and have a local US address (and proof of address such as official documents in your name).

However, it might be challenging for you to open a business bank account in such countries as a foreigner. That is why we recommend opening a bank account in Hong Kong or Singapore. Their processes are much simpler than those in other jurisdictions, thus they have a positive reputation. Yes, a foreigner can open a bank account in the US without needing a US address. However, not all banking institutions allow for it. Even traditional banks that do offer accounts to non-residents often have requirements – like opening the account in person – that make it difficult for non-residents to apply.

Can a non resident of USA open a bank account in USA

Key takeaways. Non-U.S. citizens can open bank accounts in the U.S., but may need to go through extra steps, especially if they're nonresidents. Some banks and credit unions accept alternative forms of identification, such as an Individual Taxpayer Identification Number (ITIN), for non-U.S. citizens to open accounts.One of the most popular banks for foreigners is Fio, Air, and Equa bank where you can make an account free of charge.The Czech Republic has plenty of banks with English-speaking staff, making it easy to open a bank account in the country. Some of the most popular local retail banks are Česká spořitelna, Citibank, ČSOB (Československá Obchodní Banka), Equa Bank and Expobank. Banks and credit unions that accept alternative IDs

Bank or credit union

Requirements

Alliant Credit Union

No residency requirements, but non-expired ITIN is required

Axos Bank

Varies

Bank of America

Must be living in the U.S.

Chime

Permanent residency required

What European banks are in the USA : European banks in the U.S.

Barclays PLC (UK)

Credit Suisse Group (Switzerland)

Deutsche Bank (Germany)

HSBC Holdings (UK)

UBS Group (Switzerland)

Do I need a US address to open a bank account : Yes, a foreigner can open a bank account in the US without needing a US address. However, not all banking institutions allow for it. Even traditional banks that do offer accounts to non-residents often have requirements – like opening the account in person – that make it difficult for non-residents to apply.

Is Wise or Revolut better

Revolut offers premium accounts with a monthly fee that offer higher limits for fee-free transactions. While Wise can facilitate foreign exchange transactions in 40 currencies and operates in 160 countries, Revolut can send money in 70 currencies to 160 countries, according to their respective websites. HSBC Global at a glance

No monthly costs.

No set-up cost.

No ATM fees worldwide.

No foreign transaction fees.

NerdWallet's Best Banks for International Travel

Schwab Bank: Best for Using ATMs.

Capital One: Best for Foreign transaction fees.

HSBC: Best for Expats with high balances.

Citibank, N.A.: Best for Wiring money.

Revolut: Best for Nonbank multicurrency account.

Can you open a US bank account online : You can apply online for a checking account if you're 18 years or older and a legal U.S. resident. You'll need the following information: Your Social Security number. A valid, government-issued photo ID like a driver's license, passport or state or military ID.

Antwort Can I open a bank account outside the US? Weitere Antworten – How can I open a bank account outside the US

Things to know

Generally foreign or offshore bank accounts will split into different account types, depending on customer needs. If you're a legal resident overseas with a valid visa and local address you'll usually be able to open the same selection of accounts anyone else would in your new country.Having a checking account can be a way to build a solid foundation for your financial life in the U.S. Some non-residents sometimes believe they're ineligible to open a bank account in this country. Fortunately, that isn't true. Many financial institutions offer U.S. bank accounts for non-residents.

How to open a bank account in Czech Republic : Two official identification documents, including: ID card, birth certificate, health insurance card, passport, proof of address, driving license or employee identification card. If you're a student and want to establish a student account, the bank will require a certificate of study or visa for the Czech Republic.

Which USA bank is for international

Citibank. Citibank is one of the best international banks in the US for expat banking because of their very international model. It currently physically operates in 97 markets 2, supporting clients from more than 160 countries, making access to their ATMs more convenient.

Can I open a bank account online without going to the bank USA : You'll usually find you can open a US bank account online if you're a legal US resident aged 18 or over, and have a local US address (and proof of address such as official documents in your name).

However, it might be challenging for you to open a business bank account in such countries as a foreigner. That is why we recommend opening a bank account in Hong Kong or Singapore. Their processes are much simpler than those in other jurisdictions, thus they have a positive reputation.

Yes, a foreigner can open a bank account in the US without needing a US address. However, not all banking institutions allow for it. Even traditional banks that do offer accounts to non-residents often have requirements – like opening the account in person – that make it difficult for non-residents to apply.

Can a non resident of USA open a bank account in USA

Key takeaways. Non-U.S. citizens can open bank accounts in the U.S., but may need to go through extra steps, especially if they're nonresidents. Some banks and credit unions accept alternative forms of identification, such as an Individual Taxpayer Identification Number (ITIN), for non-U.S. citizens to open accounts.One of the most popular banks for foreigners is Fio, Air, and Equa bank where you can make an account free of charge.The Czech Republic has plenty of banks with English-speaking staff, making it easy to open a bank account in the country. Some of the most popular local retail banks are Česká spořitelna, Citibank, ČSOB (Československá Obchodní Banka), Equa Bank and Expobank.

Banks and credit unions that accept alternative IDs

What European banks are in the USA : European banks in the U.S.

Do I need a US address to open a bank account : Yes, a foreigner can open a bank account in the US without needing a US address. However, not all banking institutions allow for it. Even traditional banks that do offer accounts to non-residents often have requirements – like opening the account in person – that make it difficult for non-residents to apply.

Is Wise or Revolut better

Revolut offers premium accounts with a monthly fee that offer higher limits for fee-free transactions. While Wise can facilitate foreign exchange transactions in 40 currencies and operates in 160 countries, Revolut can send money in 70 currencies to 160 countries, according to their respective websites.

HSBC Global at a glance

NerdWallet's Best Banks for International Travel

Can you open a US bank account online : You can apply online for a checking account if you're 18 years or older and a legal U.S. resident. You'll need the following information: Your Social Security number. A valid, government-issued photo ID like a driver's license, passport or state or military ID.