Once you have reached the activation form, you will be asked to provide the full card number, CVV, your date of birth and SSN. Once these steps have been completed, the new card will be ready to use for purchases immediately.You are required to activate your new credit card within 30 days of card issuance. In cases, where the card issuer, does not provide any consent to the card issuer, then the credit card will be closed by the issuer within 7 days of seeking the consent.No matter where you bank, the process is similar. You can call the automated number on the card to activate it and set up your PIN number. Or, you can activate the card through your bank, by using it at an ATM, or by making a purchase anywhere Visa is accepted.

Can you activate a credit card without the card : Credit card activation typically requires the credit card number, the security code (CVV), or both. The exact steps required to activate a credit card depend on the card's issuer, so it's best to follow the instructions from the sticker attached to your card. If you've lost your sticker…

Can I activate credit card after 1 year

On the 365th day of inactivity, we will provide you an additional 30-day grace period to activate your card.

Is there a time limit to activate a bank card : Generally, banks require customers to activate their debit card within a certain time period after receiving it, which is usually between 30 to 60 days. If you do not activate your debit card within this time frame, your account may be frozen or closed.

If you don't activate a credit card and thus don't use the card, your account may be closed. Card issuers typically close accounts that aren't used within a certain time period, usually over a year. There is no deadline for you to activate your ATM/debit card. What should I do if I suspect my ATM, debit and/or credit card(s) has been tampered with

How long can I wait to activate a debit card

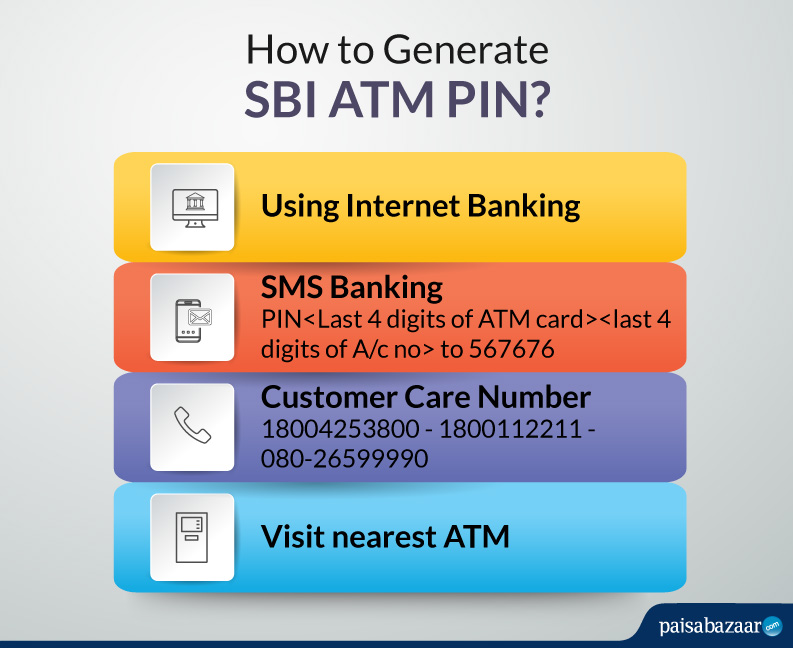

While there is no specific time frame for activating a debit card, it is generally advisable to activate it as soon as you receive it to ensure its security and usability.Then, you need to activate your card within a specified period. Otherwise, the PIN becomes invalid, and you cannot make any transactions on the card until you generate a new PIN by visiting the Online SBI portal, ATM or bank branch.You usually have 45-60 days to activate a new credit card before your credit card issuer sends you a message or cancels your account. Not activating may affect your credit score because your credit utilization ratio or credit mix may be impacted if your card issuer closes the account. If you don't activate your card your account will still be open, you just won't be able to use it.

Is there any time limit to activate ATM card : There is no deadline for you to activate your ATM/debit card. What should I do if I suspect my ATM, debit and/or credit card(s) has been tampered with

Is there a time limit to activate a debit card : While there is no specific time frame for activating a debit card, it is generally advisable to activate it as soon as you receive it to ensure its security and usability.

How to activate an expired ATM card

Whether you're starting a new bank account or your old debit card just expired, it looks like it's time to activate your new ATM card. This process is super simple—you can usually just activate your card at an ATM owned by your bank. Yes, you can change your SBI ATM PIN anytime you want using SBI internet banking, mobile banking app, ATM, SMS, or dialling the toll-free helpline number.You won't be able to use the card or enjoy its benefits, and it could end up hurting your credit scores in the long run.

How can I activate my ATM card after long time : Here's how to activate an ATM Card via ATM in the following few steps:

Visit the nearest ATM of the bank whose card you have applied for.

Click on 'Set PIN'.

You will receive an activation code on your registered mobile number.

Antwort Can I activate ATM card after 1 year? Weitere Antworten – How long after activating my credit card can I use it

immediately

Once you have reached the activation form, you will be asked to provide the full card number, CVV, your date of birth and SSN. Once these steps have been completed, the new card will be ready to use for purchases immediately.You are required to activate your new credit card within 30 days of card issuance. In cases, where the card issuer, does not provide any consent to the card issuer, then the credit card will be closed by the issuer within 7 days of seeking the consent.No matter where you bank, the process is similar. You can call the automated number on the card to activate it and set up your PIN number. Or, you can activate the card through your bank, by using it at an ATM, or by making a purchase anywhere Visa is accepted.

Can you activate a credit card without the card : Credit card activation typically requires the credit card number, the security code (CVV), or both. The exact steps required to activate a credit card depend on the card's issuer, so it's best to follow the instructions from the sticker attached to your card. If you've lost your sticker…

Can I activate credit card after 1 year

On the 365th day of inactivity, we will provide you an additional 30-day grace period to activate your card.

Is there a time limit to activate a bank card : Generally, banks require customers to activate their debit card within a certain time period after receiving it, which is usually between 30 to 60 days. If you do not activate your debit card within this time frame, your account may be frozen or closed.

If you don't activate a credit card and thus don't use the card, your account may be closed. Card issuers typically close accounts that aren't used within a certain time period, usually over a year.

There is no deadline for you to activate your ATM/debit card. What should I do if I suspect my ATM, debit and/or credit card(s) has been tampered with

How long can I wait to activate a debit card

While there is no specific time frame for activating a debit card, it is generally advisable to activate it as soon as you receive it to ensure its security and usability.Then, you need to activate your card within a specified period. Otherwise, the PIN becomes invalid, and you cannot make any transactions on the card until you generate a new PIN by visiting the Online SBI portal, ATM or bank branch.You usually have 45-60 days to activate a new credit card before your credit card issuer sends you a message or cancels your account. Not activating may affect your credit score because your credit utilization ratio or credit mix may be impacted if your card issuer closes the account.

If you don't activate your card your account will still be open, you just won't be able to use it.

Is there any time limit to activate ATM card : There is no deadline for you to activate your ATM/debit card. What should I do if I suspect my ATM, debit and/or credit card(s) has been tampered with

Is there a time limit to activate a debit card : While there is no specific time frame for activating a debit card, it is generally advisable to activate it as soon as you receive it to ensure its security and usability.

How to activate an expired ATM card

Whether you're starting a new bank account or your old debit card just expired, it looks like it's time to activate your new ATM card. This process is super simple—you can usually just activate your card at an ATM owned by your bank.

Yes, you can change your SBI ATM PIN anytime you want using SBI internet banking, mobile banking app, ATM, SMS, or dialling the toll-free helpline number.You won't be able to use the card or enjoy its benefits, and it could end up hurting your credit scores in the long run.

How can I activate my ATM card after long time : Here's how to activate an ATM Card via ATM in the following few steps: