To start investing in stocks, you'll need to open an account with a stockbroker. You can open a share dealing account with us within minutes and access 13,000+ stocks to invest in, including big names such as Apple, Netflix and Tesla. You have no obligation to fund the account until you're ready to invest.One of the easiest ways is to open an online brokerage account and buy stocks or stock funds. If you're not comfortable with that, you can work with a professional to manage your portfolio, often for a reasonable fee. Either way, you can invest in stock online at little cost.You can simply keep cash at home or opt to invest in:

Insurance plans.

Mutual funds.

Fixed deposits, Public Provident Fund (PPF) and small savings accounts.

Real estate.

Stock market.

Commodities.

Derivatives and foreign exchange.

New class of assets.

How to invest in S&P 500 UK : Can I invest in the S&P 500 from the UK Yes, you can invest in the S&P 500 but you can't invest directly in the index. However, you can buy stocks and shares in the companies listed in the S&P 500. Another way to invest in an index is to buy index mutual funds or index ETFs that track the performance of the S&P 500.

Can a UK citizen invest in US stock market

UK investors in international shares need to be mindful of both US and UK income tax laws: US withholding tax: The US levies a 30% tax on dividends paid to foreign investors, which can be reduced to 15% by completing a W-8BEN form through your broker.

How to invest in S&P 500 : The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

The DIY option: opening an investment account

With a broker, you can open an individual retirement account, also known as an IRA, or you can open a taxable brokerage account if you're already saving adequately for retirement in an employer 401(k) or other plan. The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

How to invest in S&P 500 index fund

How to invest in an S&P 500 index fund

Find your S&P 500 index fund. It's actually easy to find an S&P 500 index fund, even if you're just starting to invest.

Go to your investing account or open a new one.

Determine how much you can afford to invest.

Buy the index fund.

The best S&P 500 ETF by 1-year fund return as of 30/04/2024

1

Amundi S&P 500 II UCITS ETF Acc

+22.82%

2

iShares S&P 500 Swap UCITS ETF USD (Acc)

+21.97%

3

Amundi S&P 500 II UCITS ETF USD Dist

+21.91%

S&P 500 index funds trade through brokers and discount brokers and may be accessed directly from the fund companies. Investors may also access ETFs and mutual funds through employer 401(k) programs, individual retirement accounts (IRA), or roboadvisor platforms. UK residents aren't subject to paying tax on US shares from the UK, but they do have to pay a tax on any dividends or income received from those US stocks. This tax is called a withholding tax (WHT) and it's 15%. Any dividends or income received from US stocks must receive this WHT 15% tax.

Do UK citizens pay tax on US stocks : AS a UK investor living in the UK the only tax ( if any ) is capital gains tax. Which would be noted on your UK tax return, there is nothing for you to do with US tax authorities. Also any dividends you receive would go onto your tax return.

How to invest in S&P 500 from the UK : How to invest in the S&P 500 from the UK

Find an S&P 500 index fund or ETF. We have some examples of S&P 500 funds at the top of this page as well as information on how to choose an S&P 500 index fund.

Open a share dealing account.

Top up your account.

Buy the S&P 500 fund.

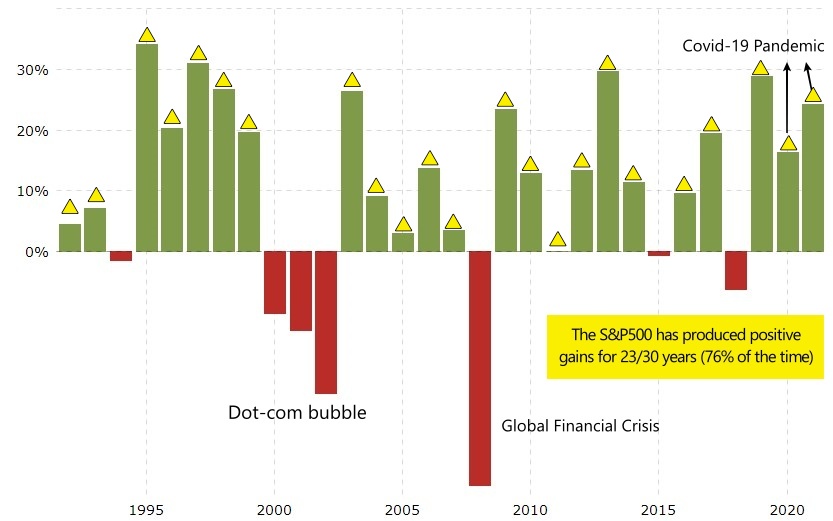

Is investing in S&P 500 safe

If you're buying a stock index fund or almost any broadly diversified stock fund such as one based on the S&P 500, it can be a good time to buy if you're prepared to hold it for the long term. That's because the market tends to rise over time, as the economy grows and corporate profits increase. To buy stocks, you'll typically need the assistance of a stockbroker since you cannot simply call up a stock exchange and ask to buy stocks directly. When you use a stockbroker, whether a human being or an online platform, you can choose the investment that you wish to buy or sell and how the trade should be handled.The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF. Index funds typically carry less risk than individual stocks.

How to invest in the S&P 500 in the UK : Can I invest in the S&P 500 from the UK Yes, you can invest in the S&P 500 but you can't invest directly in the index. However, you can buy stocks and shares in the companies listed in the S&P 500. Another way to invest in an index is to buy index mutual funds or index ETFs that track the performance of the S&P 500.

Antwort Can British people invest in S&P 500? Weitere Antworten – How to invest in the stock market in the UK

To start investing in stocks, you'll need to open an account with a stockbroker. You can open a share dealing account with us within minutes and access 13,000+ stocks to invest in, including big names such as Apple, Netflix and Tesla. You have no obligation to fund the account until you're ready to invest.One of the easiest ways is to open an online brokerage account and buy stocks or stock funds. If you're not comfortable with that, you can work with a professional to manage your portfolio, often for a reasonable fee. Either way, you can invest in stock online at little cost.You can simply keep cash at home or opt to invest in:

How to invest in S&P 500 UK : Can I invest in the S&P 500 from the UK Yes, you can invest in the S&P 500 but you can't invest directly in the index. However, you can buy stocks and shares in the companies listed in the S&P 500. Another way to invest in an index is to buy index mutual funds or index ETFs that track the performance of the S&P 500.

Can a UK citizen invest in US stock market

UK investors in international shares need to be mindful of both US and UK income tax laws: US withholding tax: The US levies a 30% tax on dividends paid to foreign investors, which can be reduced to 15% by completing a W-8BEN form through your broker.

How to invest in S&P 500 : The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

The DIY option: opening an investment account

With a broker, you can open an individual retirement account, also known as an IRA, or you can open a taxable brokerage account if you're already saving adequately for retirement in an employer 401(k) or other plan.

The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

How to invest in S&P 500 index fund

How to invest in an S&P 500 index fund

The best S&P 500 ETF by 1-year fund return as of 30/04/2024

S&P 500 index funds trade through brokers and discount brokers and may be accessed directly from the fund companies. Investors may also access ETFs and mutual funds through employer 401(k) programs, individual retirement accounts (IRA), or roboadvisor platforms.

UK residents aren't subject to paying tax on US shares from the UK, but they do have to pay a tax on any dividends or income received from those US stocks. This tax is called a withholding tax (WHT) and it's 15%. Any dividends or income received from US stocks must receive this WHT 15% tax.

Do UK citizens pay tax on US stocks : AS a UK investor living in the UK the only tax ( if any ) is capital gains tax. Which would be noted on your UK tax return, there is nothing for you to do with US tax authorities. Also any dividends you receive would go onto your tax return.

How to invest in S&P 500 from the UK : How to invest in the S&P 500 from the UK

Is investing in S&P 500 safe

If you're buying a stock index fund or almost any broadly diversified stock fund such as one based on the S&P 500, it can be a good time to buy if you're prepared to hold it for the long term. That's because the market tends to rise over time, as the economy grows and corporate profits increase.

To buy stocks, you'll typically need the assistance of a stockbroker since you cannot simply call up a stock exchange and ask to buy stocks directly. When you use a stockbroker, whether a human being or an online platform, you can choose the investment that you wish to buy or sell and how the trade should be handled.The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF. Index funds typically carry less risk than individual stocks.

How to invest in the S&P 500 in the UK : Can I invest in the S&P 500 from the UK Yes, you can invest in the S&P 500 but you can't invest directly in the index. However, you can buy stocks and shares in the companies listed in the S&P 500. Another way to invest in an index is to buy index mutual funds or index ETFs that track the performance of the S&P 500.