Credit card companies and banks generally use software to extract geolocation data and leverage it for information like the malicious user's time zone, internet service provider (ISP), and exact location of the fraudster at the time of the fraudulent purchase.Banks leverage sophisticated rule-based detection systems that monitor transaction patterns and flag anomalies. These systems analyze factors such as transaction frequency, amount, and geographical location, comparing them against established customer profiles and historical data.Anti-money laundering

All federally-regulated banks are required by law to report major money transactions to the Financial Crimes Enforcement Network, or FinCEN, which is a bureau of the U.S. Department of the Treasury.

Do banks monitor activity : Transaction monitoring is the means by which a bank monitors its customers' financial activity for signs of money laundering, terrorism financing, and other financial crimes.

Can a bank track a VPN

Can banks detect a VPN While a bank cannot tell that you're using a VPN specifically, they can see your IP address — or rather, the IP address of the VPN server you're connected to. This won't always be a problem because your IP address does change depending on the network you're connected to.

Can a bank track the location of a transaction : Most of the time, the bank will be able to track down the person who uses your card. They may view the time, place, and merchant who processed the transaction. Additionally, they might perhaps obtain the IP address of the device that was used to complete the transaction.

Will appear as only fans. So if you have a busy body living in your house or maybe you share a bank statement with them. And you don't want them to know that you have an only fan. Subscription. Can bank tellers see what you buy Bank tellers have access to your bank transactions, so they see where you shopped and how much you spent.

Can my bank account be tracked

No, you cannot trace bank details or account number based on a transaction reference number.$10,000 or

When Does a Bank Have to Report Your Deposit Banks report individuals who deposit $10,000 or more in cash. The IRS typically shares suspicious deposit or withdrawal activity with local and state authorities, Castaneda says.How Do Banks Investigate Fraud Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction. Can You Track Someone Who Used Your Credit Card Online No. However, if you report the fraud in a timely manner, the bank or card issuer will open an investigation. Banks have a system for investigating credit card fraud, including some standard procedures.

Can your bank see what you buy : Can bank tellers see what you buy Bank tellers have access to your bank transactions, so they see where you shopped and how much you spent.

How to pay OnlyFans discreetly : For truly anonymous OnlyFans use, buy a pre-paid Visa card at local retailer using cash, provide only a PO Box for your address, and load your card up with more cash every month to keep your OnlyFans subscriptions up to date.

Do banks keep track of purchases

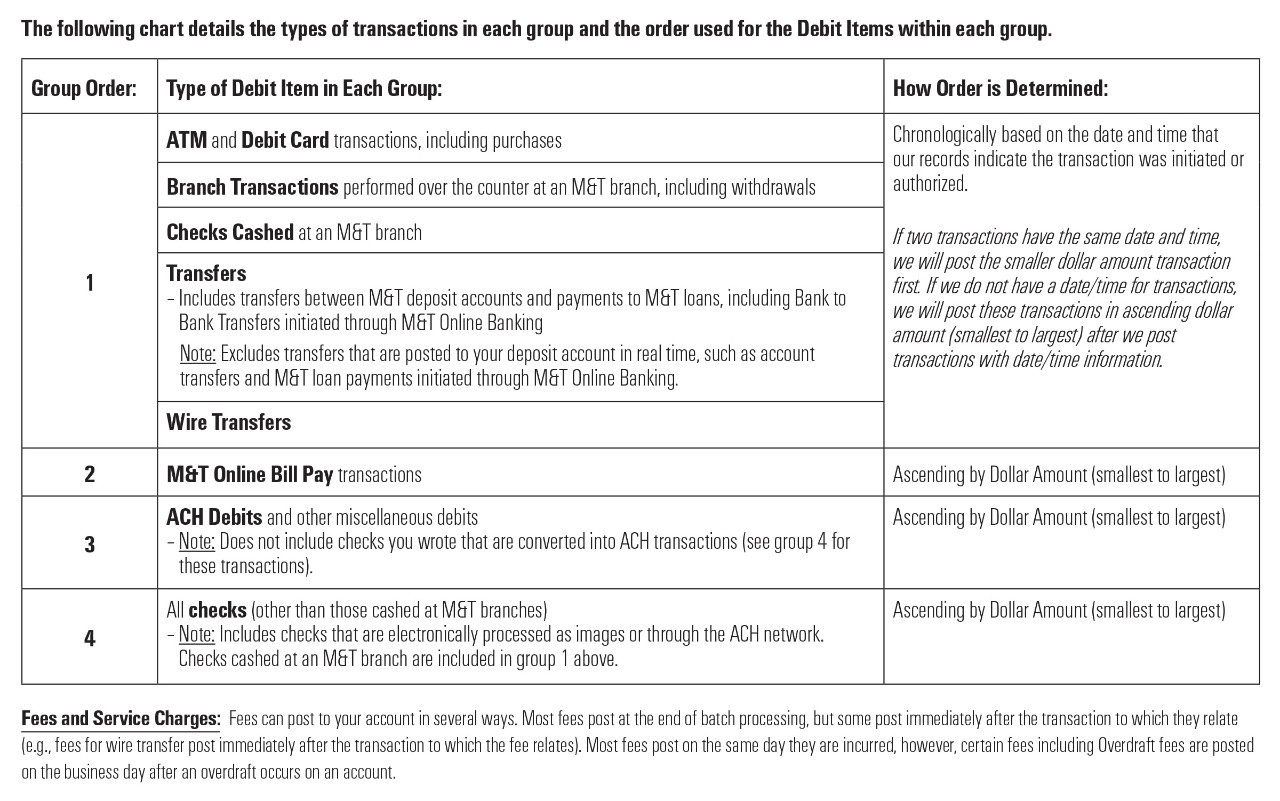

Typically financial institutions will “post" all transactions that have been presented to your account at the end of the day. It's important to know how your bank prioritizes items to be debited from your account. Anonymous bank accounts are also called numbered accounts. They are a type of account where the identity of the account holder is replaced by a multi-digit number or code. The client's name is only accessible to the client and a small circle of senior staff at the bank.Banks can't share any information unless you say it's ok to do so. Once you've provided your consent by adding an account, you'll be asked every 90 days if it's still ok for us to continue receiving your data.

What is the $3000 rule : Rule. The requirement that financial institutions verify and record the identity of each cash purchaser of money orders and bank, cashier's, and traveler's checks in excess of $3,000.

Antwort Can banks track you? Weitere Antworten – Can banks track your location

Credit card companies and banks generally use software to extract geolocation data and leverage it for information like the malicious user's time zone, internet service provider (ISP), and exact location of the fraudster at the time of the fraudulent purchase.Banks leverage sophisticated rule-based detection systems that monitor transaction patterns and flag anomalies. These systems analyze factors such as transaction frequency, amount, and geographical location, comparing them against established customer profiles and historical data.Anti-money laundering

All federally-regulated banks are required by law to report major money transactions to the Financial Crimes Enforcement Network, or FinCEN, which is a bureau of the U.S. Department of the Treasury.

Do banks monitor activity : Transaction monitoring is the means by which a bank monitors its customers' financial activity for signs of money laundering, terrorism financing, and other financial crimes.

Can a bank track a VPN

Can banks detect a VPN While a bank cannot tell that you're using a VPN specifically, they can see your IP address — or rather, the IP address of the VPN server you're connected to. This won't always be a problem because your IP address does change depending on the network you're connected to.

Can a bank track the location of a transaction : Most of the time, the bank will be able to track down the person who uses your card. They may view the time, place, and merchant who processed the transaction. Additionally, they might perhaps obtain the IP address of the device that was used to complete the transaction.

Will appear as only fans. So if you have a busy body living in your house or maybe you share a bank statement with them. And you don't want them to know that you have an only fan. Subscription.

Can bank tellers see what you buy Bank tellers have access to your bank transactions, so they see where you shopped and how much you spent.

Can my bank account be tracked

No, you cannot trace bank details or account number based on a transaction reference number.$10,000 or

When Does a Bank Have to Report Your Deposit Banks report individuals who deposit $10,000 or more in cash. The IRS typically shares suspicious deposit or withdrawal activity with local and state authorities, Castaneda says.How Do Banks Investigate Fraud Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction.

Can You Track Someone Who Used Your Credit Card Online No. However, if you report the fraud in a timely manner, the bank or card issuer will open an investigation. Banks have a system for investigating credit card fraud, including some standard procedures.

Can your bank see what you buy : Can bank tellers see what you buy Bank tellers have access to your bank transactions, so they see where you shopped and how much you spent.

How to pay OnlyFans discreetly : For truly anonymous OnlyFans use, buy a pre-paid Visa card at local retailer using cash, provide only a PO Box for your address, and load your card up with more cash every month to keep your OnlyFans subscriptions up to date.

Do banks keep track of purchases

Typically financial institutions will “post" all transactions that have been presented to your account at the end of the day. It's important to know how your bank prioritizes items to be debited from your account.

Anonymous bank accounts are also called numbered accounts. They are a type of account where the identity of the account holder is replaced by a multi-digit number or code. The client's name is only accessible to the client and a small circle of senior staff at the bank.Banks can't share any information unless you say it's ok to do so. Once you've provided your consent by adding an account, you'll be asked every 90 days if it's still ok for us to continue receiving your data.

What is the $3000 rule : Rule. The requirement that financial institutions verify and record the identity of each cash purchaser of money orders and bank, cashier's, and traveler's checks in excess of $3,000.