In summary, we do not believe that the stock market is currently a “bubble.” Certainly not like it was in 1999-2000. But, we do believe that AI is an historic new technology, and investors should own stocks in leaders in this field, albeit only at reasonable prices.A double is a bubble.

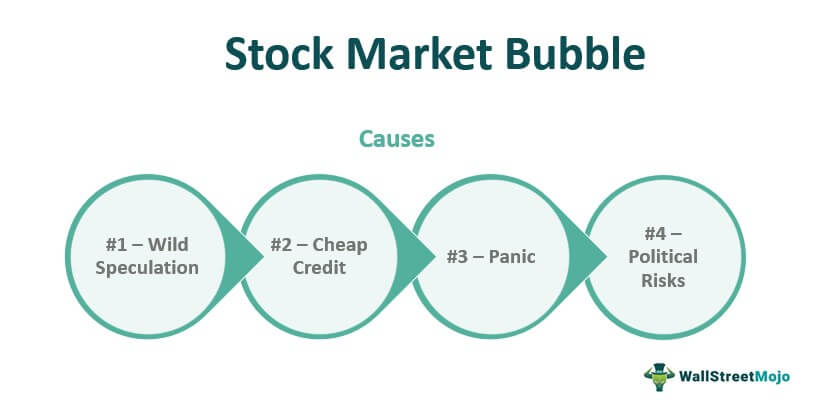

Colas has a simple rule of thumb to identify unsustainably high prices in a range of markets. Whenever the S&P 500 doubles in three years or less, stock prices decline shortly thereafter.A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior.

Do stocks bounce back : Sharp market declines can be painful, but stocks tend to bounce back relatively quickly. Past performance does not guarantee future results.

How will stocks do in 2024

As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.

Is it good time to buy stocks : Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.

A look at Price / Sales, one of the most basic valuation ratios, suggests an affirmation of the question at hand: is Nvidia overvalued. The Price / Sales ratio reflects how much you have to pay per $ of sales to own the stock. At around 40x Price / Sales, NVDA is among the most expensive companies out there. Data from the eight most prominent such events in history reveals that an economic, asset, market bubble lasts for about 5.6 years or about 67.5 months.

What are the 5 stages of the bubble

practitioners and some academics have taken Minsky's ideas and characterized various stages of bubbles: displacement, boom, euphoria, profit-taking, and panic.Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 88% to 149%, depending on the indicator, down from last month's 92% to 154%.The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024. Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.

Is 2024 a bull market : Here are some reasons why 2024 is shaping up to be a historic bull market. The 'sell in May and go away' adage says to sell in May and go away thru October. A full 6 months. And then buy back into the market in November and stay in thru April.

Should I pull my money out of the stock market in 2024 : Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

What is the 3 day rule in stocks

The 3-Day Rule in stock trading refers to the settlement rule that requires the finalization of a transaction within three business days after the trade date. This rule impacts how payments and orders are processed, requiring traders to have funds or credit in their accounts to cover purchases by the settlement date. Here's the real truth: It's never too late to start growing your money. And while time does matter when it comes to investing, it doesn't need to matter in the way you might think. You may be surprised at the impact just a few years can have on your savings.The biggest obstacle to Nvidia's stock price topping $1,000 is the company's recent success. How so Every quarter in which Nvidia exceeds expectations and raises guidance, investors expect even more of the same for the next quarter. Analysts expect the company to keep doing that for at least the next year or two.

Is Nvidia still a buy : Nvidia Stock Tops Buy Point

Chart patterns are good ways of telling when to buy or sell a stock. Nvidia's chart shows the stock topped the 922.20 buy point from a handle Wednesday. The stock is in buy range to 968.31. According to IBD MarketSurge, the stock has an alternative buy point at 974.

Antwort Are stocks a bubble? Weitere Antworten – Is the stock market in a bubble

In summary, we do not believe that the stock market is currently a “bubble.” Certainly not like it was in 1999-2000. But, we do believe that AI is an historic new technology, and investors should own stocks in leaders in this field, albeit only at reasonable prices.A double is a bubble.

Colas has a simple rule of thumb to identify unsustainably high prices in a range of markets. Whenever the S&P 500 doubles in three years or less, stock prices decline shortly thereafter.A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior.

Do stocks bounce back : Sharp market declines can be painful, but stocks tend to bounce back relatively quickly. Past performance does not guarantee future results.

How will stocks do in 2024

As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.

Is it good time to buy stocks : Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.

A look at Price / Sales, one of the most basic valuation ratios, suggests an affirmation of the question at hand: is Nvidia overvalued. The Price / Sales ratio reflects how much you have to pay per $ of sales to own the stock. At around 40x Price / Sales, NVDA is among the most expensive companies out there.

Data from the eight most prominent such events in history reveals that an economic, asset, market bubble lasts for about 5.6 years or about 67.5 months.

What are the 5 stages of the bubble

practitioners and some academics have taken Minsky's ideas and characterized various stages of bubbles: displacement, boom, euphoria, profit-taking, and panic.Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 88% to 149%, depending on the indicator, down from last month's 92% to 154%.The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.

Is 2024 a bull market : Here are some reasons why 2024 is shaping up to be a historic bull market. The 'sell in May and go away' adage says to sell in May and go away thru October. A full 6 months. And then buy back into the market in November and stay in thru April.

Should I pull my money out of the stock market in 2024 : Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

What is the 3 day rule in stocks

The 3-Day Rule in stock trading refers to the settlement rule that requires the finalization of a transaction within three business days after the trade date. This rule impacts how payments and orders are processed, requiring traders to have funds or credit in their accounts to cover purchases by the settlement date.

Here's the real truth: It's never too late to start growing your money. And while time does matter when it comes to investing, it doesn't need to matter in the way you might think. You may be surprised at the impact just a few years can have on your savings.The biggest obstacle to Nvidia's stock price topping $1,000 is the company's recent success. How so Every quarter in which Nvidia exceeds expectations and raises guidance, investors expect even more of the same for the next quarter. Analysts expect the company to keep doing that for at least the next year or two.

Is Nvidia still a buy : Nvidia Stock Tops Buy Point

Chart patterns are good ways of telling when to buy or sell a stock. Nvidia's chart shows the stock topped the 922.20 buy point from a handle Wednesday. The stock is in buy range to 968.31. According to IBD MarketSurge, the stock has an alternative buy point at 974.