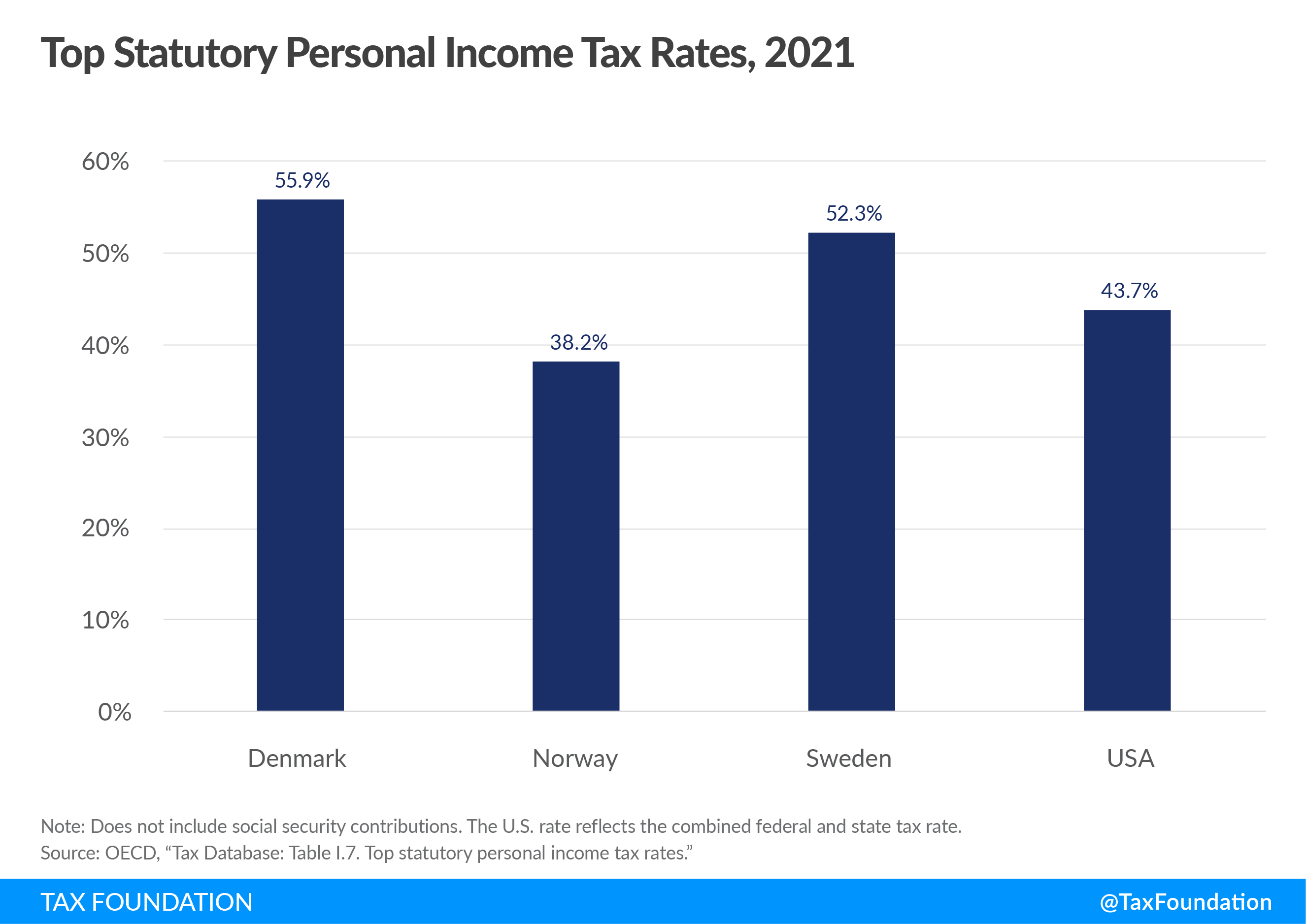

The United States ranked 31st¹ out of 38 OECD countries in terms of the tax-to-GDP ratio in 2022. In 2022, the United States had a tax-to-GDP ratio of 27.7% compared with the OECD average of 34.0%. In 2021, the United States was ranked 32nd out of the 38 OECD countries in terms of the tax-to-GDP ratio.Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024. Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top rates. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates.Ivory Coast

1. Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.

Is the USA a high tax country : Among the 34 industrialized countries included in the OECD, the United States has the highest rate at 39.1 percent. However, when compared to all the countries in the world, the United States comes in third behind Chad and the United Arab Emirates. America's corporate tax rate is much higher than the worldwide average.

Which EU country has the highest tax

Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

Which EU country has the lowest taxes : Bulgaria

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit.

Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent. Côte d'Ivoire citizens pay the highest income taxes in the world according to a survey by World Population Review. Côte d'Ivoire citizens pay the highest income taxes in the world according to this year's survey findings by World Population Review.

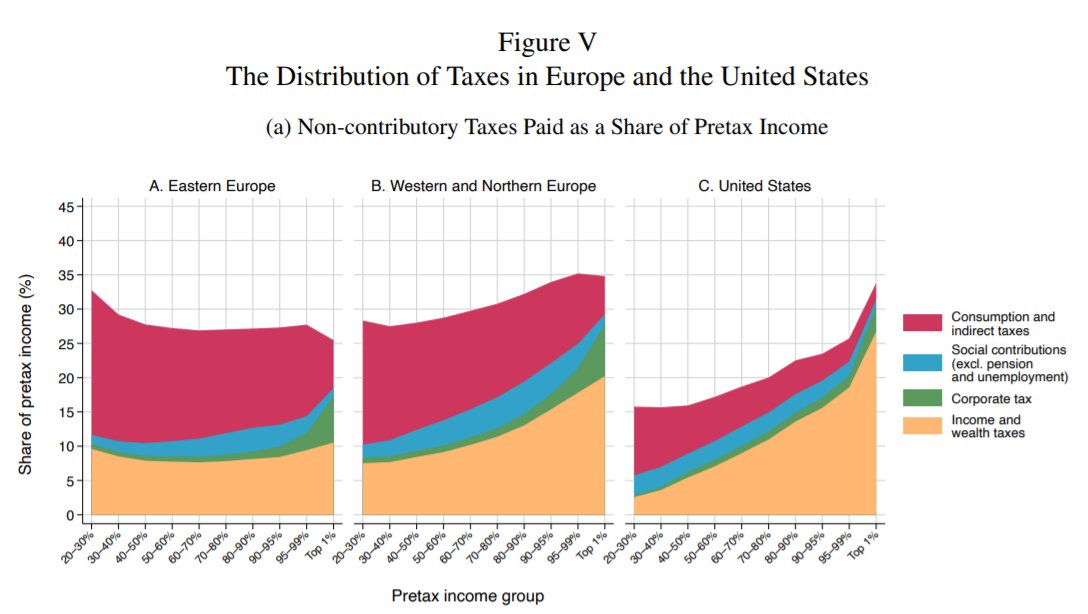

How are taxes in Europe compared to the US

The OECD median for Europe is a tax rate of 34%. This includes cost of health care. The median tax rate in the US is 26%, NOT including health care. The median cost of health care in the US is 8% of gross income, which brings the total equivalent tax rate of the US to the OECD median.Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union. Federal Income Tax Brackets Overview

The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you're one of the lucky few to earn enough to fall into the 37% bracket, that doesn't mean that the entirety of your taxable income will be subject to a 37% tax.

What is the tax rate in the Czech Republic : Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.

Who pays the highest taxes in Europe : Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

Which country in Europe has the lowest taxes

Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union. Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.Denmark (55.9%), Austria (55%), Portugal (53%), Sweden (52.3%) and Belgium (50%) are some of the countries with the highest personal income tax rates. On the other hand, Romania (10%), Bulgaria (10%), Bosnia and Herzegovina (10%), Kosovo (10%) and North Macedonia (10%) are the European countries with the lowest taxes.

Do Americans pay less taxes than Europe : In general, taxes in Europe vs US tend to be higher. When considering Denmark taxes vs US, the income tax can vary from 8 to 56.5 percent. In the case of German tax rates vs US, it can be anything from 9 to 45 percent plus a 5.5 percent solidarity surcharge if applicable.

Antwort Are European taxes higher than us? Weitere Antworten – How do taxes in the US compare to other countries

The United States ranked 31st¹ out of 38 OECD countries in terms of the tax-to-GDP ratio in 2022. In 2022, the United States had a tax-to-GDP ratio of 27.7% compared with the OECD average of 34.0%. In 2021, the United States was ranked 32nd out of the 38 OECD countries in terms of the tax-to-GDP ratio.Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024. Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top rates. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates.Ivory Coast

1. Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.

Is the USA a high tax country : Among the 34 industrialized countries included in the OECD, the United States has the highest rate at 39.1 percent. However, when compared to all the countries in the world, the United States comes in third behind Chad and the United Arab Emirates. America's corporate tax rate is much higher than the worldwide average.

Which EU country has the highest tax

Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

Which EU country has the lowest taxes : Bulgaria

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit.

Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

Côte d'Ivoire citizens pay the highest income taxes in the world according to a survey by World Population Review. Côte d'Ivoire citizens pay the highest income taxes in the world according to this year's survey findings by World Population Review.

How are taxes in Europe compared to the US

The OECD median for Europe is a tax rate of 34%. This includes cost of health care. The median tax rate in the US is 26%, NOT including health care. The median cost of health care in the US is 8% of gross income, which brings the total equivalent tax rate of the US to the OECD median.Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.

Federal Income Tax Brackets Overview

The U.S. currently has seven federal income tax brackets, with rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you're one of the lucky few to earn enough to fall into the 37% bracket, that doesn't mean that the entirety of your taxable income will be subject to a 37% tax.

What is the tax rate in the Czech Republic : Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.

Who pays the highest taxes in Europe : Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

Which country in Europe has the lowest taxes

Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.

Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.Denmark (55.9%), Austria (55%), Portugal (53%), Sweden (52.3%) and Belgium (50%) are some of the countries with the highest personal income tax rates. On the other hand, Romania (10%), Bulgaria (10%), Bosnia and Herzegovina (10%), Kosovo (10%) and North Macedonia (10%) are the European countries with the lowest taxes.

Do Americans pay less taxes than Europe : In general, taxes in Europe vs US tend to be higher. When considering Denmark taxes vs US, the income tax can vary from 8 to 56.5 percent. In the case of German tax rates vs US, it can be anything from 9 to 45 percent plus a 5.5 percent solidarity surcharge if applicable.