Really, there's no hard and fast rule about how many checking accounts any one person should have. The number and type of accounts that works for you will depend on many factors, including your financial goals, spending habits, and comfort level with monitoring and managing multiple accounts.You can have as many checking accounts as you want. Keeping track of multiple accounts is more complicated than a single checking account. However, opening and using multiple accounts can help you better manage your budget, cash flow, and other financial needs.Depending on your financial goals, you may find that having more than one bank account makes sense. But there's no correct number of bank accounts to have. The key is figuring out which combination of accounts makes for the ideal match between your financial goals and your lifestyle.

Is it OK to have 4 bank accounts : While there's no limit to how many Savings Accounts you can have, there are a few things to consider before signing up for more than one.

Is it bad to have lots of savings accounts

The right number of savings accounts is a personal decision, but in many cases it may be a smart strategy to have more than one. There's no limit to the number of savings accounts you can have, but the key is to make sure you can manage them all.

Is having too many bank accounts bad for credit : Will having two or more current accounts damage my credit score Not necessarily, no. However, having two or more current accounts won't necessarily damage your credit score, but it could have a negative impact if you start dipping into multiple overdrafts – making it look as if your finances are becoming stretched.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

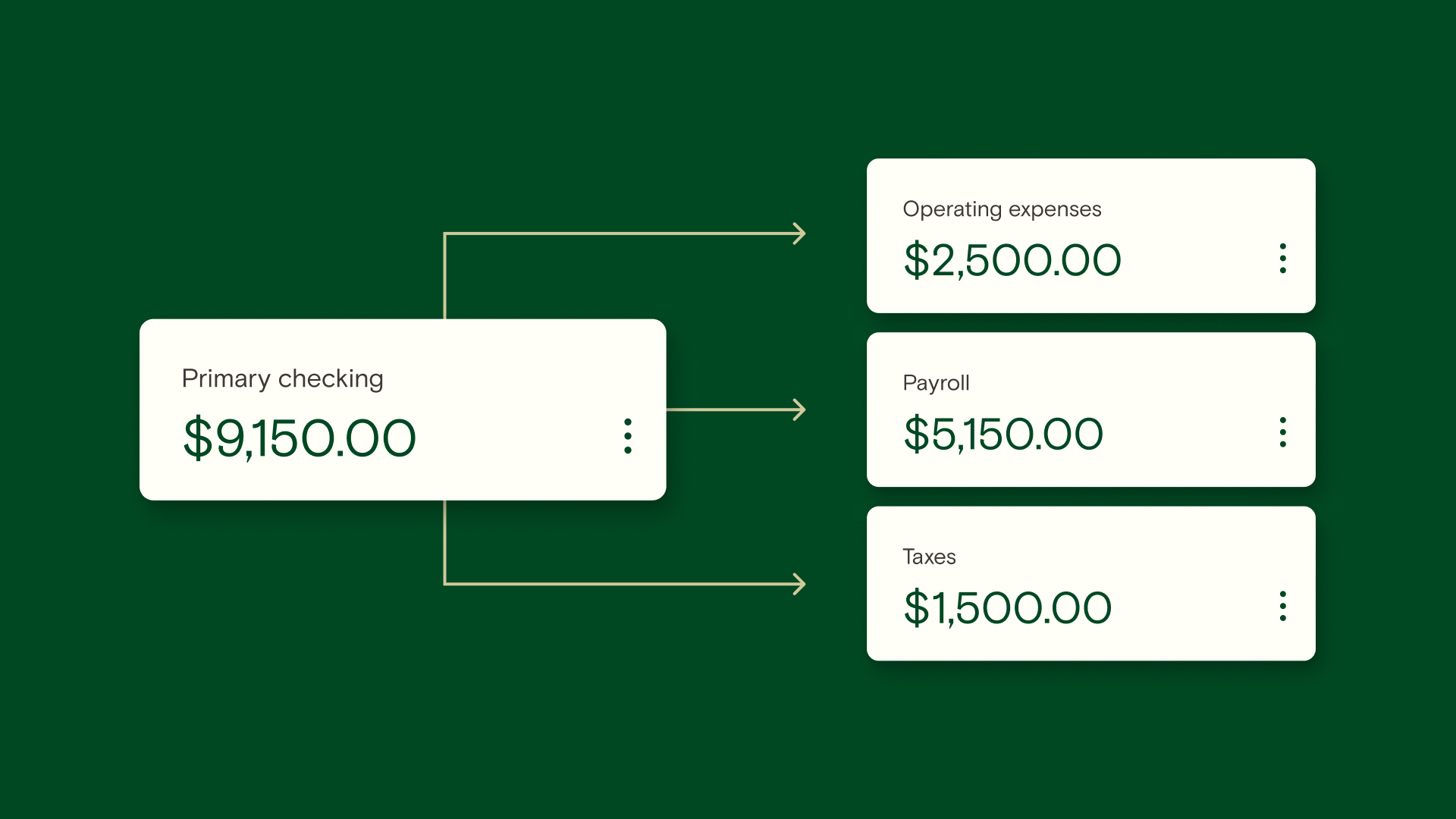

The ideal number of bank accounts depends on your financial habits and needs. You might be happy with just two accounts – checking and savings – or you may want multiple accounts to separate business and personal expenses, share a bank account with a partner or maintain separate accounts for various financial goals.

Is 4 savings accounts too many

There's no limit to how many savings accounts you can have. Having just one savings account can simplify money management. Having multiple savings accounts may let you easily stash cash for different goals.If you're looking for a ballpark figure, Taylor Kovar, certified financial planner and CEO of Kovar Wealth Management says, “By age 30, a good rule of thumb is to aim to have saved the equivalent of your annual salary.Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking, savings and assets to determine whether you have the capacity to take on more debt.

Aim to have three to six months' worth of expenses set aside. To figure out how much you should have saved for emergencies, simply multiply the amount of money you spend each month on expenses by either three or six months to get your target goal amount.

How much should a 21 year old have in their bank : However, a good rule of thumb for a 21-year-old is to have $6,000 in a savings account for emergencies and long-term financial goals. And that requires you to learn how to start budgeting and saving money. If you're nowhere near that amount, don't panic.

Can I have 10 savings accounts : There's no limit to the number of savings accounts you can have, but the key is to make sure you can manage them all. Learn why you may want to have as many savings accounts as you have savings goals, and what to consider when shopping for a savings account.

Is 40k a lot of money saved

While $40,000 is a good start on the road to building a nest egg, you probably want to retire with a lot more money than that. But it may be more than possible if you commit to saving and investing in a brokerage account consistently for the remainder of your career.

Try to keep all your bank accounts — particularly checking accounts — active by consistently meeting your bank's minimum transaction requirements. If you find that any of your accounts have fallen inactive, don't hesitate to close them and deposit the funds into an account you use more regularly.Will having two or more current accounts damage my credit score Not necessarily, no. However, having two or more current accounts won't necessarily damage your credit score, but it could have a negative impact if you start dipping into multiple overdrafts – making it look as if your finances are becoming stretched.

Is 10k a lot of money : For most, $10,000 is a lot of money. Typically, that amount of money doesn't just appear out of thin air without some financial strain. However, if you think about $10,000 as saving a little over $27 each day, it becomes much more realistic.

Antwort Is it bad to have too many bank accounts? Weitere Antworten – Is it bad to have multiple bank accounts

Really, there's no hard and fast rule about how many checking accounts any one person should have. The number and type of accounts that works for you will depend on many factors, including your financial goals, spending habits, and comfort level with monitoring and managing multiple accounts.You can have as many checking accounts as you want. Keeping track of multiple accounts is more complicated than a single checking account. However, opening and using multiple accounts can help you better manage your budget, cash flow, and other financial needs.Depending on your financial goals, you may find that having more than one bank account makes sense. But there's no correct number of bank accounts to have. The key is figuring out which combination of accounts makes for the ideal match between your financial goals and your lifestyle.

Is it OK to have 4 bank accounts : While there's no limit to how many Savings Accounts you can have, there are a few things to consider before signing up for more than one.

Is it bad to have lots of savings accounts

The right number of savings accounts is a personal decision, but in many cases it may be a smart strategy to have more than one. There's no limit to the number of savings accounts you can have, but the key is to make sure you can manage them all.

Is having too many bank accounts bad for credit : Will having two or more current accounts damage my credit score Not necessarily, no. However, having two or more current accounts won't necessarily damage your credit score, but it could have a negative impact if you start dipping into multiple overdrafts – making it look as if your finances are becoming stretched.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings.

The ideal number of bank accounts depends on your financial habits and needs. You might be happy with just two accounts – checking and savings – or you may want multiple accounts to separate business and personal expenses, share a bank account with a partner or maintain separate accounts for various financial goals.

Is 4 savings accounts too many

There's no limit to how many savings accounts you can have. Having just one savings account can simplify money management. Having multiple savings accounts may let you easily stash cash for different goals.If you're looking for a ballpark figure, Taylor Kovar, certified financial planner and CEO of Kovar Wealth Management says, “By age 30, a good rule of thumb is to aim to have saved the equivalent of your annual salary.Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking, savings and assets to determine whether you have the capacity to take on more debt.

Aim to have three to six months' worth of expenses set aside. To figure out how much you should have saved for emergencies, simply multiply the amount of money you spend each month on expenses by either three or six months to get your target goal amount.

How much should a 21 year old have in their bank : However, a good rule of thumb for a 21-year-old is to have $6,000 in a savings account for emergencies and long-term financial goals. And that requires you to learn how to start budgeting and saving money. If you're nowhere near that amount, don't panic.

Can I have 10 savings accounts : There's no limit to the number of savings accounts you can have, but the key is to make sure you can manage them all. Learn why you may want to have as many savings accounts as you have savings goals, and what to consider when shopping for a savings account.

Is 40k a lot of money saved

While $40,000 is a good start on the road to building a nest egg, you probably want to retire with a lot more money than that. But it may be more than possible if you commit to saving and investing in a brokerage account consistently for the remainder of your career.

Try to keep all your bank accounts — particularly checking accounts — active by consistently meeting your bank's minimum transaction requirements. If you find that any of your accounts have fallen inactive, don't hesitate to close them and deposit the funds into an account you use more regularly.Will having two or more current accounts damage my credit score Not necessarily, no. However, having two or more current accounts won't necessarily damage your credit score, but it could have a negative impact if you start dipping into multiple overdrafts – making it look as if your finances are becoming stretched.

Is 10k a lot of money : For most, $10,000 is a lot of money. Typically, that amount of money doesn't just appear out of thin air without some financial strain. However, if you think about $10,000 as saving a little over $27 each day, it becomes much more realistic.