The Fed has stated on numerous occasions that its goal is an annual inflation rate of 2%.In an inflationary environment, unevenly rising prices inevitably reduce the purchasing power of some consumers, and this erosion of real income is the single biggest cost of inflation. Inflation can also distort purchasing power over time for recipients and payers of fixed interest rates.High inflation means that prices are increasing quickly, with low inflation meaning that prices are increasing more slowly. Inflation can be contrasted with deflation, which occurs when prices decline and purchasing power increases.

How does inflation work : Inflation occurs when the prices of goods and services increase over a long period of time, causing your purchasing power, or the amount of goods and services you can buy with a single unit of currency, to decrease. In short, inflation means that your money may not be able to buy as much today as it could in the past.

Is 15% an acceptable inflation rate

Inflation levels of 1% to 2% per year are generally considered acceptable, while inflation rates greater than 3% to 4% can represent an overheating economy.

Why is 0% inflation bad : The reason that zero inflation creates such large costs to the economy is that firms are reluctant to cut wages. In both good times and bad, some firms and industries do better than others. Wages need to adjust to accommodate these differences in economic fortunes.

The middle class typically benefits from inflation because the middle class typically has a lot of debt. Think of someone who owes $100,000 on a $200,000 home. Inflation makes the home more valuable and the debt relatively less onerous. But Biden-era very high inflation is less helpful to the middle class.

Economists believe inflation is the result of an increase in the amount of money relative to the supply of available goods. While high inflation is generally considered harmful, some economists believe that a small amount of inflation can help drive economic growth.

What does a 10% inflation rate mean

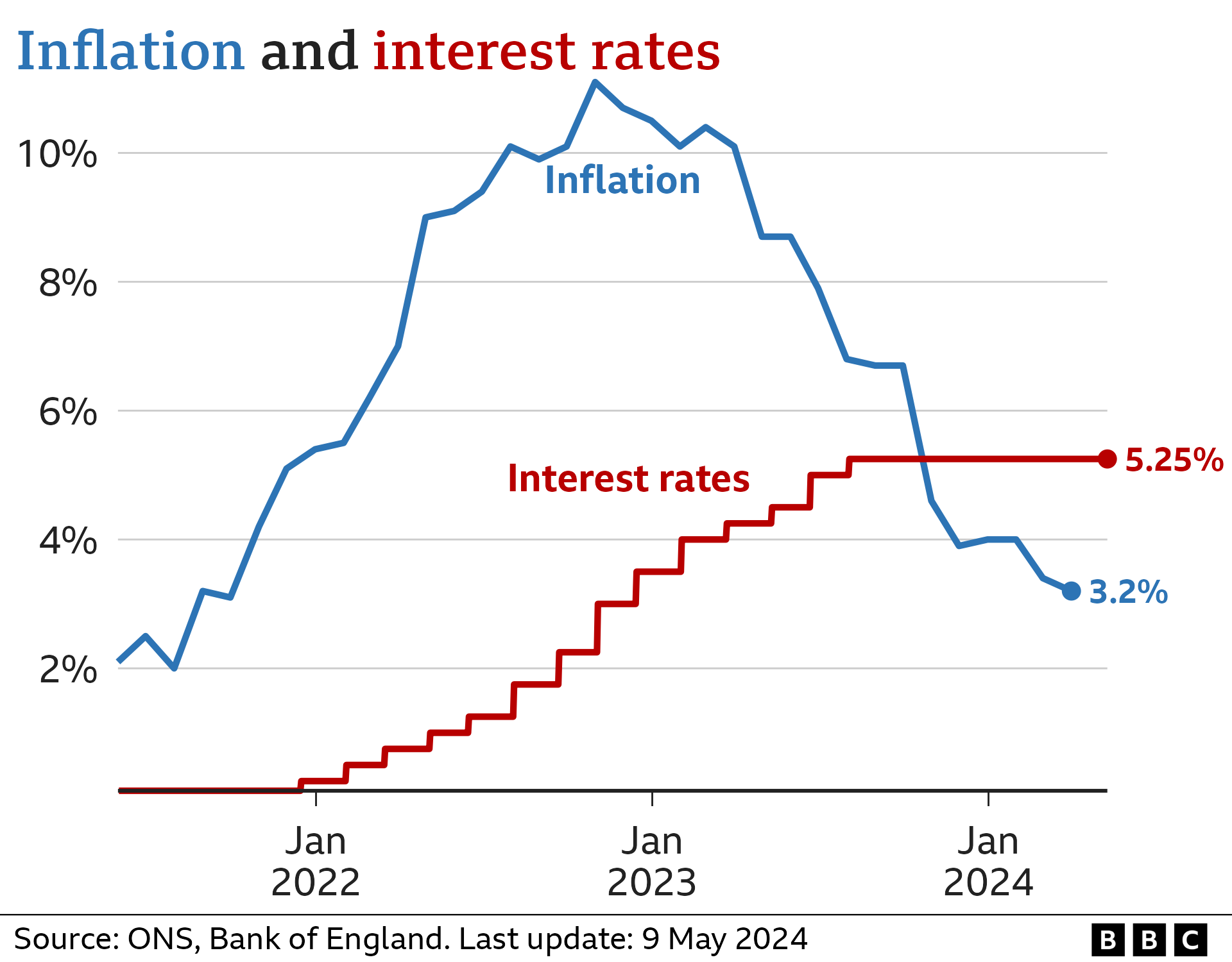

The easiest way to illustrate inflation is through an example. Suppose you can buy a burger for $2 this year and the yearly inflation rate is 10%. Theoretically, 10% inflation means that next year the same burger will cost 10% more, or $2.20.An inflation rate of 5% per year means that if your shopping costs you $100 today, it would have cost you about only $95 a year ago. If inflation stays at 5%, the same basket of shopping will cost you $105 in a year's time.Inflation allows borrowers to pay lenders back with money worth less than when it was originally borrowed, which benefits borrowers. When inflation causes higher prices, the demand for credit increases, raising interest rates, which benefits lenders.

If you're wondering how to calculate the inflation rate, estimating the inflation rate involves some straightforward steps:

Subtract an item's original cost from its present cost.

Divide the result by the original cost.

Multiply by 100.

Is 1% inflation bad : Inflation is a sustained increase in prices of goods and services, which can negatively impact purchasing power and lead to tough financial decisions for consumers. The Federal Reserve targets a 2% annual inflation rate as a sign of a healthy economy.

Why is 0 inflation bad : The reason that zero inflation creates such large costs to the economy is that firms are reluctant to cut wages. In both good times and bad, some firms and industries do better than others. Wages need to adjust to accommodate these differences in economic fortunes.

Why is 2% inflation better than 0

Why has the inflation target been set at 2%, rather than at 0% A price growth rate of 2% is low enough to fully reap the benefits of price stability and, at the same time, it provides a margin to reduce the risk of deflation.

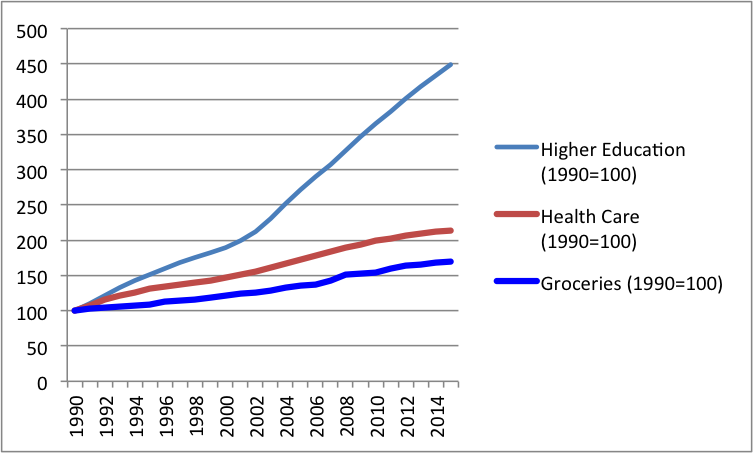

Why low inflation is bad. Very low inflation usually signals demand for goods and services is lower than it should be, and this tends to slow economic growth and depress wages.Prior research suggests that inflation hits low-income households hardest for several reasons. They spend more of their income on necessities such as food, gas and rent—categories with greater-than-average inflation rates—leaving few ways to reduce spending .

Why is 2% inflation good : Two percent is supposed to be the sweet spot for inflation, low enough for consumer comfort but relaxed enough for the economy to flourish, according to Fed doctrine settled years ago.

Antwort What does 10% inflation mean? Weitere Antworten – What is a good inflation rate

2%

The Fed has stated on numerous occasions that its goal is an annual inflation rate of 2%.In an inflationary environment, unevenly rising prices inevitably reduce the purchasing power of some consumers, and this erosion of real income is the single biggest cost of inflation. Inflation can also distort purchasing power over time for recipients and payers of fixed interest rates.High inflation means that prices are increasing quickly, with low inflation meaning that prices are increasing more slowly. Inflation can be contrasted with deflation, which occurs when prices decline and purchasing power increases.

:max_bytes(150000):strip_icc()/what-causes-inflation-and-does-anyone-gain-it.asp_final-bd28a7c57a5944d9bddc8b42155f2e17.png)

How does inflation work : Inflation occurs when the prices of goods and services increase over a long period of time, causing your purchasing power, or the amount of goods and services you can buy with a single unit of currency, to decrease. In short, inflation means that your money may not be able to buy as much today as it could in the past.

Is 15% an acceptable inflation rate

Inflation levels of 1% to 2% per year are generally considered acceptable, while inflation rates greater than 3% to 4% can represent an overheating economy.

Why is 0% inflation bad : The reason that zero inflation creates such large costs to the economy is that firms are reluctant to cut wages. In both good times and bad, some firms and industries do better than others. Wages need to adjust to accommodate these differences in economic fortunes.

The middle class typically benefits from inflation because the middle class typically has a lot of debt. Think of someone who owes $100,000 on a $200,000 home. Inflation makes the home more valuable and the debt relatively less onerous. But Biden-era very high inflation is less helpful to the middle class.

Economists believe inflation is the result of an increase in the amount of money relative to the supply of available goods. While high inflation is generally considered harmful, some economists believe that a small amount of inflation can help drive economic growth.

What does a 10% inflation rate mean

The easiest way to illustrate inflation is through an example. Suppose you can buy a burger for $2 this year and the yearly inflation rate is 10%. Theoretically, 10% inflation means that next year the same burger will cost 10% more, or $2.20.An inflation rate of 5% per year means that if your shopping costs you $100 today, it would have cost you about only $95 a year ago. If inflation stays at 5%, the same basket of shopping will cost you $105 in a year's time.Inflation allows borrowers to pay lenders back with money worth less than when it was originally borrowed, which benefits borrowers. When inflation causes higher prices, the demand for credit increases, raising interest rates, which benefits lenders.

If you're wondering how to calculate the inflation rate, estimating the inflation rate involves some straightforward steps:

Is 1% inflation bad : Inflation is a sustained increase in prices of goods and services, which can negatively impact purchasing power and lead to tough financial decisions for consumers. The Federal Reserve targets a 2% annual inflation rate as a sign of a healthy economy.

Why is 0 inflation bad : The reason that zero inflation creates such large costs to the economy is that firms are reluctant to cut wages. In both good times and bad, some firms and industries do better than others. Wages need to adjust to accommodate these differences in economic fortunes.

Why is 2% inflation better than 0

Why has the inflation target been set at 2%, rather than at 0% A price growth rate of 2% is low enough to fully reap the benefits of price stability and, at the same time, it provides a margin to reduce the risk of deflation.

Why low inflation is bad. Very low inflation usually signals demand for goods and services is lower than it should be, and this tends to slow economic growth and depress wages.Prior research suggests that inflation hits low-income households hardest for several reasons. They spend more of their income on necessities such as food, gas and rent—categories with greater-than-average inflation rates—leaving few ways to reduce spending .

Why is 2% inflation good : Two percent is supposed to be the sweet spot for inflation, low enough for consumer comfort but relaxed enough for the economy to flourish, according to Fed doctrine settled years ago.