You cannot buy shares in the Dow Jones Industrial Average (DJIA), but you can buy an exchange-traded fund that tracks the index and holds all 30 of the stocks in proportion to their weights in the DJIA.Vanguard – Prospectus and reports. Online is the quickest, easiest, and most cost-effective way to transact with Vanguard. Lower costs may mean we can pass more savings on to you. SPDR® Dow Jones Industrial Average ETF Trust is offered by prospectus only.Dow Jones Industrial Average (INDEXDJX DJI) – ETF Tracker

Symbol

ETF Name

Total Assets*

DIA

SPDR Dow Jones Industrial Average ETF Trust

$32,694,300

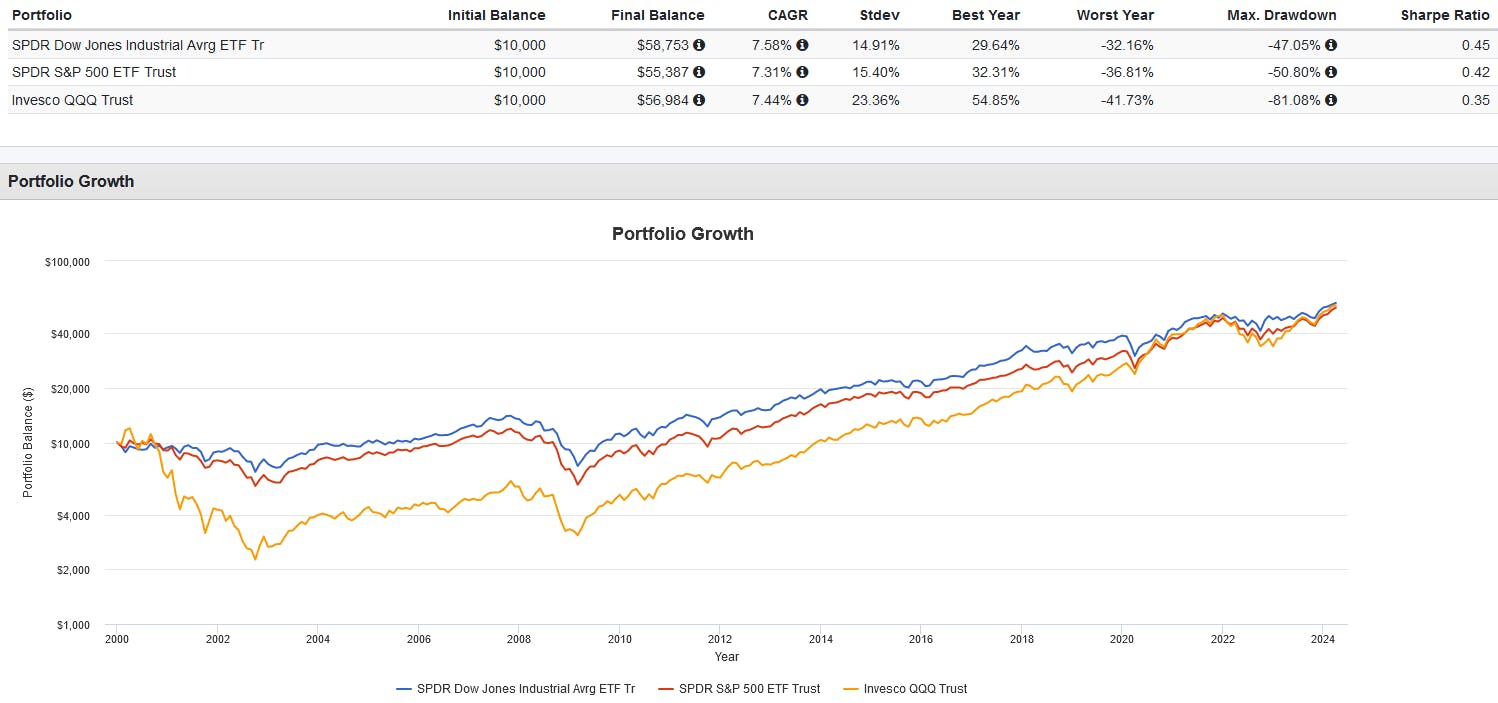

Is it better to invest in Dow Jones or S&P 500 : If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.

Can I buy Nasdaq index fund

The Nasdaq 100 is an index, so it cannot be directly invested in, but investors can gain exposure to the index through exchange-traded funds (ETFs), mutual funds, futures and options, and annuities.

Are there Nasdaq index funds : Best Nasdaq index funds

The Nasdaq-100 Index is another stock market index, but is not as diversified as the S&P 500 because of its large weighting in technology shares. These two funds track the largest non-financial companies in the index.

The SPDR Dow Industrial Average ETF is the simplest and best way to invest in the Dow. The expense ratio is a reasonable 0.16%, and it has over $31 billion in net assets, making it one of the largest Dow ETFs.

The SPDR Dow Jones Industrial Average ETF Trust (DIA) is the top (and only) exchange-traded fund tracking the Dow.

Is Dow Jones same as S&P

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.The SPDR Dow Jones Industrial Average ETF Trust (DIA) is the top (and only) exchange-traded fund tracking the Dow.They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

The Nasdaq-100 is heavily allocated towards top-performing industries such as Technology, Consumer Discretionary, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between December 31, 2007, and March 31, 2023.

Is Nasdaq better than S&P 500 : The CAGR returns have been in the range of 23-40%. The significantly higher allocation towards FAANG stocks has ensured that Nasdaq 100 has outperformed S&P 500 index by a wide margin.

Is Nasdaq an ETF or index fund : Two popular ETFs are the Standard and Poor's depositary receipt (SPDR) launched in 1993 and the NASDAQ-100 Index Tracking Stock (QQQ) which was launched in 1999. These vehicles are popular for hedging as well as investment. Also known as ETF.

What is the best Dow Jones ETF

Return comparison of all Dow Jones Industrial Average ETFs

ETF

2024 in %

Lyxor Dow Jones Industrial Average UCITS ETF Dist

+ 4.10%

iShares Dow Jones Industrial Average UCITS ETF (Acc)

+ 3.83%

Amundi PEA Dow Jones Industrial Average UCITS ETF Dist

+ 3.80%

iShares Dow Jones Industrial Average UCITS ETF (DE)

+ 3.67%

ETFs. Since the Dow Jones is simply a measure of its underlying stocks' performance, you can't invest in it directly—instead, you can invest with an index fund either through a mutual fund or an ETF that strives to match the performance of the market index.ETFs. Since the Dow Jones is simply a measure of its underlying stocks' performance, you can't invest in it directly—instead, you can invest with an index fund either through a mutual fund or an ETF that strives to match the performance of the market index.

Is Dow Jones in S&P 500 : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Antwort Is there a Dow Jones index Fund? Weitere Antworten – Can you buy a Dow Jones index fund

Advisor Insight

You cannot buy shares in the Dow Jones Industrial Average (DJIA), but you can buy an exchange-traded fund that tracks the index and holds all 30 of the stocks in proportion to their weights in the DJIA.Vanguard – Prospectus and reports. Online is the quickest, easiest, and most cost-effective way to transact with Vanguard. Lower costs may mean we can pass more savings on to you. SPDR® Dow Jones Industrial Average ETF Trust is offered by prospectus only.Dow Jones Industrial Average (INDEXDJX DJI) – ETF Tracker

Is it better to invest in Dow Jones or S&P 500 : If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.

Can I buy Nasdaq index fund

The Nasdaq 100 is an index, so it cannot be directly invested in, but investors can gain exposure to the index through exchange-traded funds (ETFs), mutual funds, futures and options, and annuities.

Are there Nasdaq index funds : Best Nasdaq index funds

The Nasdaq-100 Index is another stock market index, but is not as diversified as the S&P 500 because of its large weighting in technology shares. These two funds track the largest non-financial companies in the index.

The SPDR Dow Industrial Average ETF is the simplest and best way to invest in the Dow. The expense ratio is a reasonable 0.16%, and it has over $31 billion in net assets, making it one of the largest Dow ETFs.

The SPDR Dow Jones Industrial Average ETF Trust (DIA) is the top (and only) exchange-traded fund tracking the Dow.

Is Dow Jones same as S&P

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.The SPDR Dow Jones Industrial Average ETF Trust (DIA) is the top (and only) exchange-traded fund tracking the Dow.They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

The Nasdaq-100 is heavily allocated towards top-performing industries such as Technology, Consumer Discretionary, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between December 31, 2007, and March 31, 2023.

Is Nasdaq better than S&P 500 : The CAGR returns have been in the range of 23-40%. The significantly higher allocation towards FAANG stocks has ensured that Nasdaq 100 has outperformed S&P 500 index by a wide margin.

Is Nasdaq an ETF or index fund : Two popular ETFs are the Standard and Poor's depositary receipt (SPDR) launched in 1993 and the NASDAQ-100 Index Tracking Stock (QQQ) which was launched in 1999. These vehicles are popular for hedging as well as investment. Also known as ETF.

What is the best Dow Jones ETF

Return comparison of all Dow Jones Industrial Average ETFs

ETFs. Since the Dow Jones is simply a measure of its underlying stocks' performance, you can't invest in it directly—instead, you can invest with an index fund either through a mutual fund or an ETF that strives to match the performance of the market index.ETFs. Since the Dow Jones is simply a measure of its underlying stocks' performance, you can't invest in it directly—instead, you can invest with an index fund either through a mutual fund or an ETF that strives to match the performance of the market index.

Is Dow Jones in S&P 500 : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).