By all accounts, Silicon Valley was an unusual bank. Its management took excessive risks by buying billions of dollars of mortgage-backed securities and Treasury bonds when interest rates were low.Silicon Valley Bank (SVB) key statistics

SVB revenue in 2022 was $7.401 billion. SVB's profit for 2022 was $1.509 billion. As of 2022, Silicon Valley Bank customers held a total of $341.5 billion in deposits. As of 2022, Silicon Valley Bank had a headcount of approximately 8,553 employees.Goldman Sachs acted as both the buyer of SVB-held bonds and the architect of failed efforts to raise capital for the bank, raking in profits and fees even as SVB was seized by the Federal Deposit Insurance Corporation (FDIC) in a failure that cost the Federal Deposit Insurance Fund $20 billion and caused 'macro ripples …

Was SVB corrupt : The spectacular collapse of Silicon Valley Bank was caused by corruption, financial recklessness and poor decision-making.

Who is SVB biggest customers

SVB's biggest depositor was Circle Internet Financial, the stablecoin firm behind USD Coin. The FDIC document shows that Circle held $3.3 billion at SVB, a figure that the stablecoin company previously disclosed.

Who were the biggest investors in SVB : Top Institutional Holders

Holder

Shares

Date Reported

SVB Wealth LLC

24.03k

Dec 31, 2023

Bartlett & Co.

185

Dec 31, 2023

FSA Wealth Management, LLC

45

Dec 31, 2023

Tucker Asset Management LLC

1.35k

Dec 31, 2023

The bank's customers were primarily businesses and people in the technology, life science, healthcare, private equity, venture capital and premium wine industries.

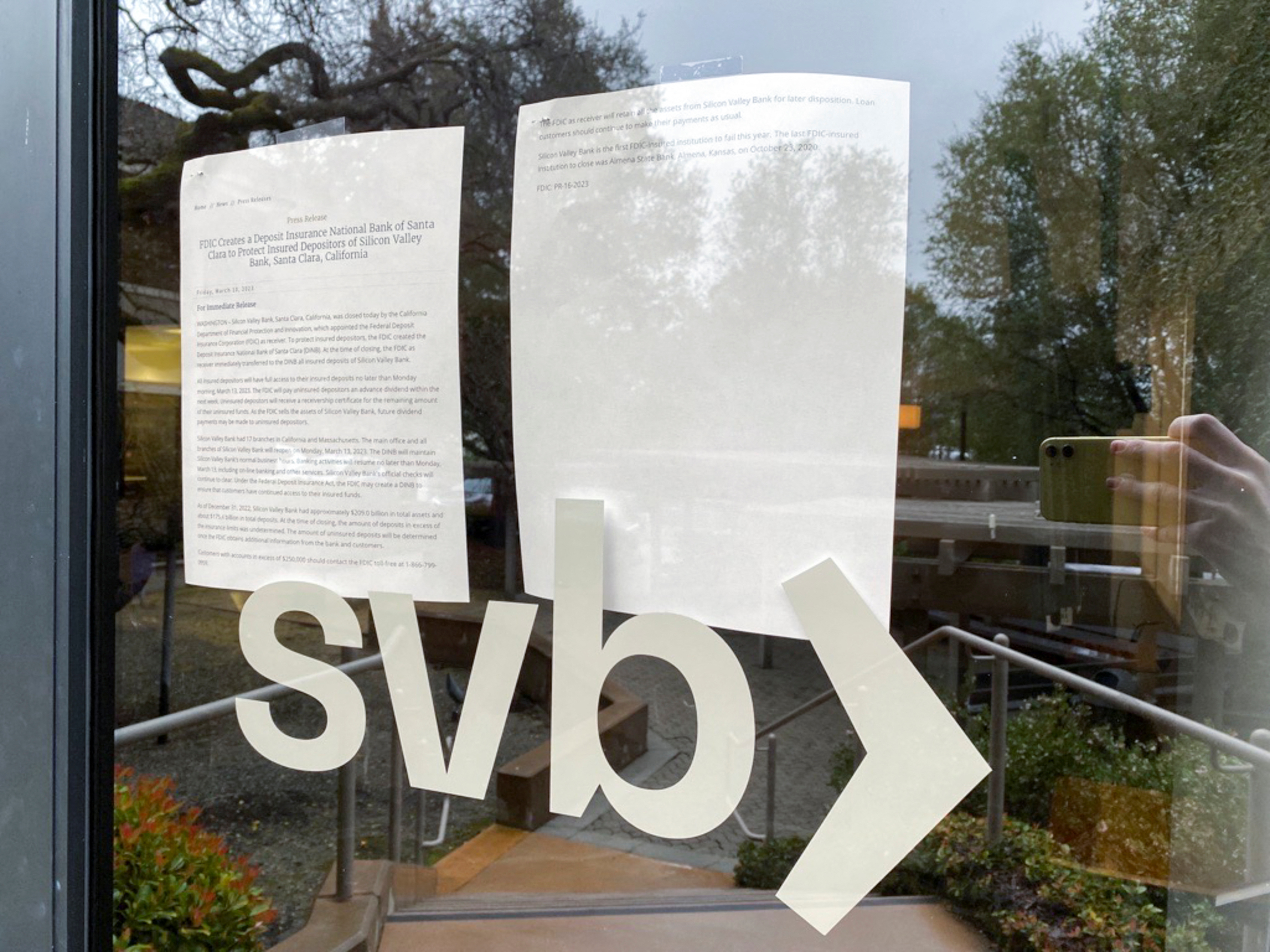

The collapse of Silicon Valley Bank (SVB) set the Federal Deposit Insurance Corporation (FDIC) back only $20 billion while the failure of Signature Bank cost just $2.5 billion, according to prepared remarks by FDIC Chair Martin Gruenberg set to be delivered in front of the Senate Banking Committee on Tuesday.

Who is to blame for the SVB collapse

And the culprit in this case was the very institution whose mission is to prevent bank runs and systemic collapse: the Federal Reserve.First Citizens BancSharesSilicon Valley Bank / Parent organization

Is SVB now a part of First Citizens Bank Silicon Valley Bank was acquired by First Citizens Bank on March 27, 2023. Silicon Valley Bank is open and operating as a division of First Citizens Bank serving the same investor and innovation economy clients that it has for the past 40 years.Because investors could buy bonds at higher interest rates, Silicon Valley Bank's bonds declined in value. As this was happening, some of Silicon Valley Bank's customers—many of whom are in the technology industry—hit financial troubles, and many began to withdraw funds from their accounts.

The collapse of Silicon Valley Bank is the largest bank failure in the United States since the global financial crisis. The bank's vulnerability was the result of having a high proportion of uninsured deposits and a large proportion of deposits invested in hold-to-maturity securities.

Who profited from SVB collapse : Goldman Sachs acted as both the buyer of SVB-held bonds and the architect of failed efforts to raise capital for the bank, raking in profits and fees even as SVB was seized by the Federal Deposit Insurance Corporation (FDIC) in a failure that cost the Federal Deposit Insurance Fund $20 billion and caused 'macro ripples …

Who is responsible for SVB bank failure : And the culprit in this case was the very institution whose mission is to prevent bank runs and systemic collapse: the Federal Reserve.

Did SVB depositors get all their money

No one lost any money on deposit as a result of this transaction. Depositors of Silicon Valley Bridge Bank, N.A., will automatically become depositors of First-Citizens Bank & Trust Company.

Barr released a lengthy review of the Fed's supervision and regulation of SVB. The Fed highlighted four causes of the bank's failure: SVB's board of directors and management failed to manage their risks. Fed supervisors did not fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity.However, the Treasury Department, the Federal Reserve, and the FDIC announced they would make sure all depositors with accounts at SVB and Signature Bank would have access to their funds by the next day – beyond just the $250,000 guaranteed by the FDIC.

Is SVB still operating today : Silicon Valley Bank was acquired by First Citizens Bank on March 27, 2023. Silicon Valley Bank is open and operating as a division of First Citizens Bank serving the same investor and innovation economy clients that it has for the past 40 years.

Antwort Why did SVB lose so much money? Weitere Antworten – Did SVB take on too much risk

By all accounts, Silicon Valley was an unusual bank. Its management took excessive risks by buying billions of dollars of mortgage-backed securities and Treasury bonds when interest rates were low.Silicon Valley Bank (SVB) key statistics

SVB revenue in 2022 was $7.401 billion. SVB's profit for 2022 was $1.509 billion. As of 2022, Silicon Valley Bank customers held a total of $341.5 billion in deposits. As of 2022, Silicon Valley Bank had a headcount of approximately 8,553 employees.Goldman Sachs acted as both the buyer of SVB-held bonds and the architect of failed efforts to raise capital for the bank, raking in profits and fees even as SVB was seized by the Federal Deposit Insurance Corporation (FDIC) in a failure that cost the Federal Deposit Insurance Fund $20 billion and caused 'macro ripples …

Was SVB corrupt : The spectacular collapse of Silicon Valley Bank was caused by corruption, financial recklessness and poor decision-making.

Who is SVB biggest customers

SVB's biggest depositor was Circle Internet Financial, the stablecoin firm behind USD Coin. The FDIC document shows that Circle held $3.3 billion at SVB, a figure that the stablecoin company previously disclosed.

Who were the biggest investors in SVB : Top Institutional Holders

The bank's customers were primarily businesses and people in the technology, life science, healthcare, private equity, venture capital and premium wine industries.

The collapse of Silicon Valley Bank (SVB) set the Federal Deposit Insurance Corporation (FDIC) back only $20 billion while the failure of Signature Bank cost just $2.5 billion, according to prepared remarks by FDIC Chair Martin Gruenberg set to be delivered in front of the Senate Banking Committee on Tuesday.

Who is to blame for the SVB collapse

And the culprit in this case was the very institution whose mission is to prevent bank runs and systemic collapse: the Federal Reserve.First Citizens BancSharesSilicon Valley Bank / Parent organization

Is SVB now a part of First Citizens Bank Silicon Valley Bank was acquired by First Citizens Bank on March 27, 2023. Silicon Valley Bank is open and operating as a division of First Citizens Bank serving the same investor and innovation economy clients that it has for the past 40 years.Because investors could buy bonds at higher interest rates, Silicon Valley Bank's bonds declined in value. As this was happening, some of Silicon Valley Bank's customers—many of whom are in the technology industry—hit financial troubles, and many began to withdraw funds from their accounts.

The collapse of Silicon Valley Bank is the largest bank failure in the United States since the global financial crisis. The bank's vulnerability was the result of having a high proportion of uninsured deposits and a large proportion of deposits invested in hold-to-maturity securities.

Who profited from SVB collapse : Goldman Sachs acted as both the buyer of SVB-held bonds and the architect of failed efforts to raise capital for the bank, raking in profits and fees even as SVB was seized by the Federal Deposit Insurance Corporation (FDIC) in a failure that cost the Federal Deposit Insurance Fund $20 billion and caused 'macro ripples …

Who is responsible for SVB bank failure : And the culprit in this case was the very institution whose mission is to prevent bank runs and systemic collapse: the Federal Reserve.

Did SVB depositors get all their money

No one lost any money on deposit as a result of this transaction. Depositors of Silicon Valley Bridge Bank, N.A., will automatically become depositors of First-Citizens Bank & Trust Company.

Barr released a lengthy review of the Fed's supervision and regulation of SVB. The Fed highlighted four causes of the bank's failure: SVB's board of directors and management failed to manage their risks. Fed supervisors did not fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity.However, the Treasury Department, the Federal Reserve, and the FDIC announced they would make sure all depositors with accounts at SVB and Signature Bank would have access to their funds by the next day – beyond just the $250,000 guaranteed by the FDIC.

Is SVB still operating today : Silicon Valley Bank was acquired by First Citizens Bank on March 27, 2023. Silicon Valley Bank is open and operating as a division of First Citizens Bank serving the same investor and innovation economy clients that it has for the past 40 years.